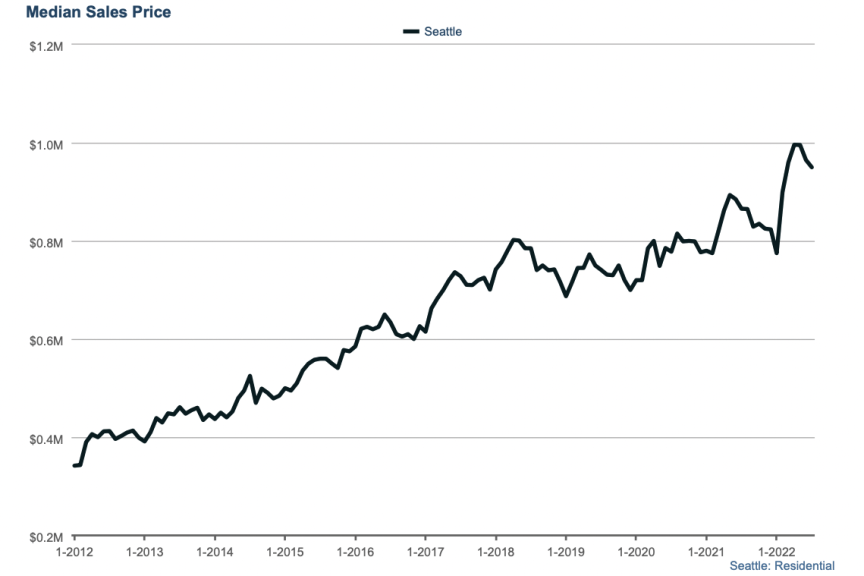

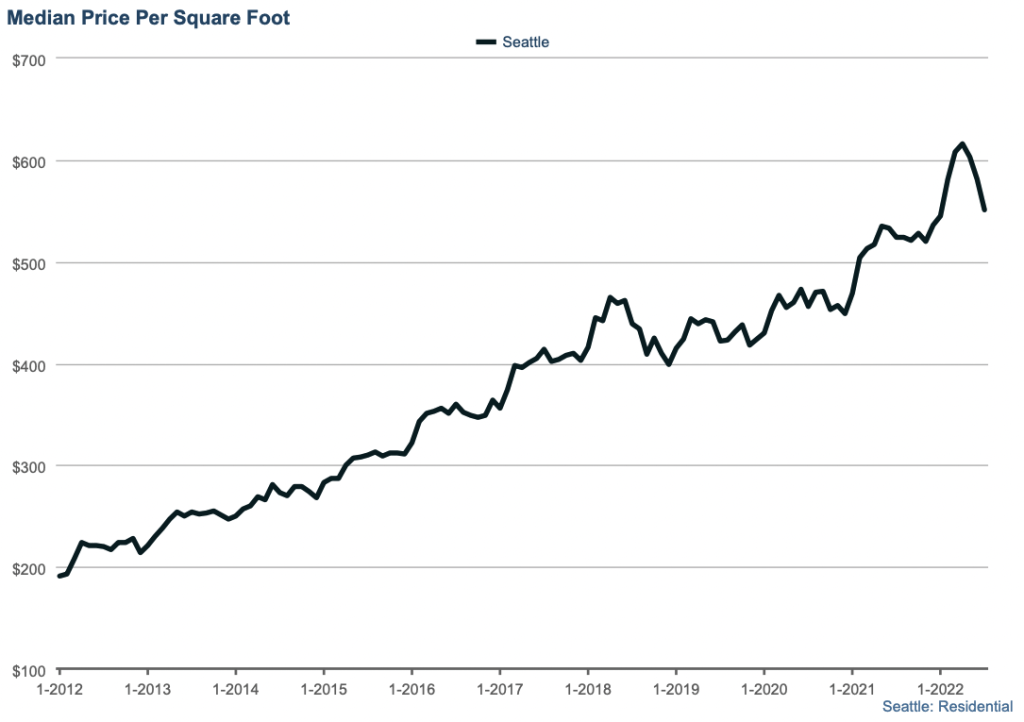

Seattle single-family July market report: median prices down $50k from all-time highs, but up nearly 10% y-o-y

The numbers for what the Seattle single-family and townhome real estate did in July are out. The headline is that the median price is now down nearly $50k from its May and April peak. However, prices are still up 9.8% year-over-year.

Here’s a deep dive into all the numbers.

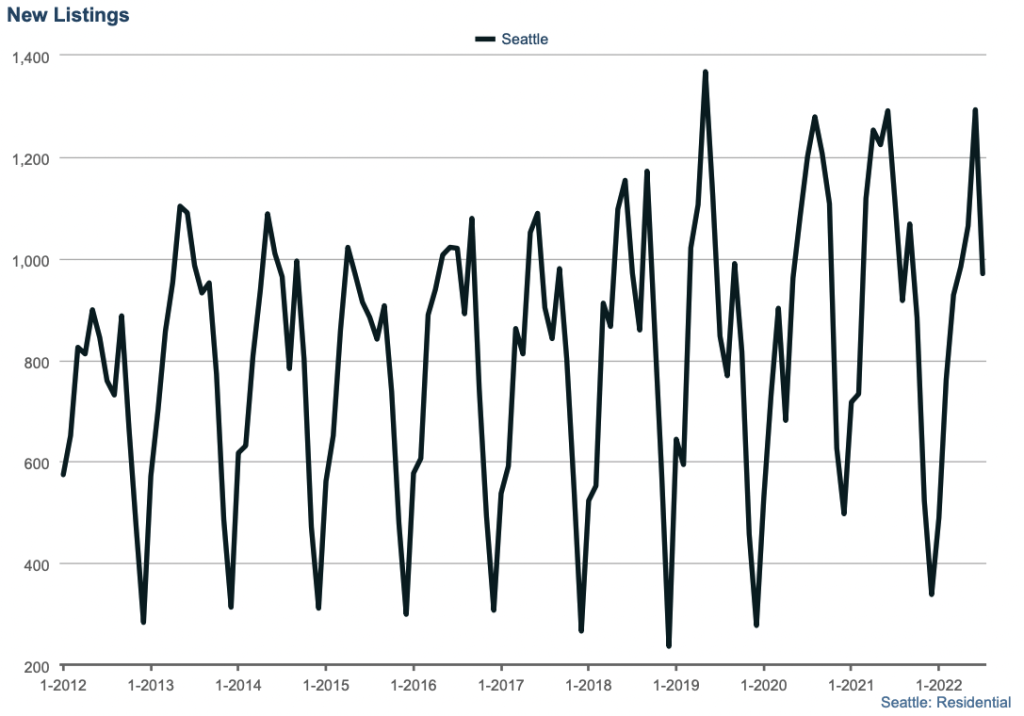

In July we saw 970 new listings, fewer than we saw in the last couple of pandemic years, but about what we’d see in a normal July. And 970 is certainly fewer than the 1,293 we saw in June which was exceptionally busy. We typically see a drop from June to July though as the market slows down for summer.

The month to watch will be September, as August will also be slow. A big increase in inventory in September should lead to more price declines.

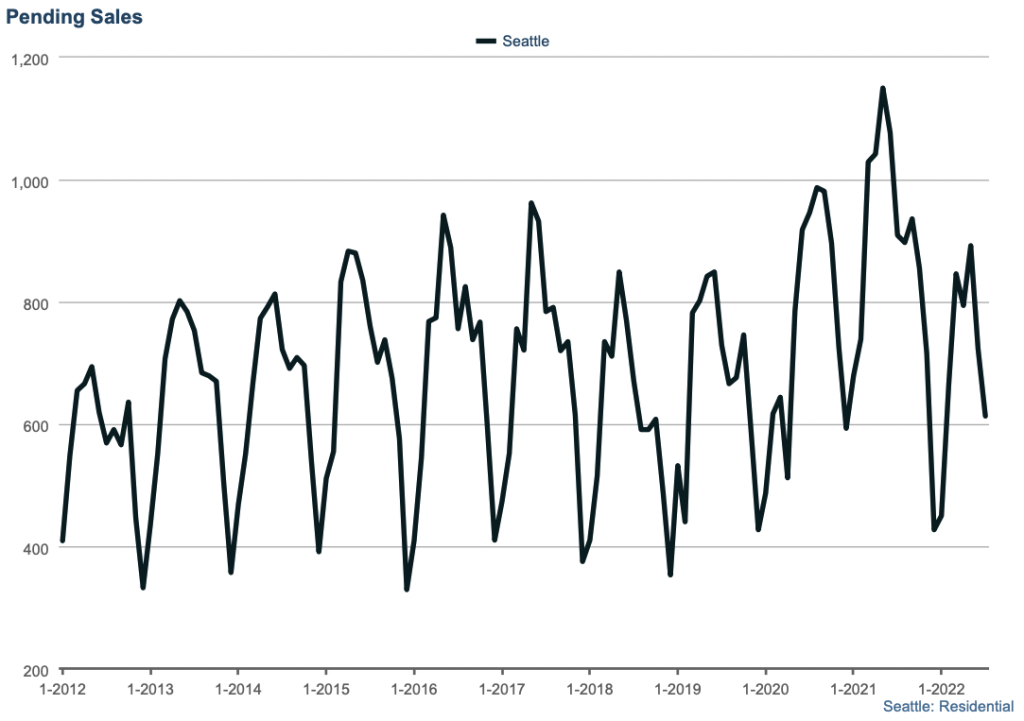

So sellers took a break in July. What about buyers? Buyers put 613 homes under contract, the second slowest July in the last ten years though this coincides with some of the highest rates we’ve seen in years. With rates now seemingly coming down, the month to watch again will be September. How many buyers come back after Labor Day?

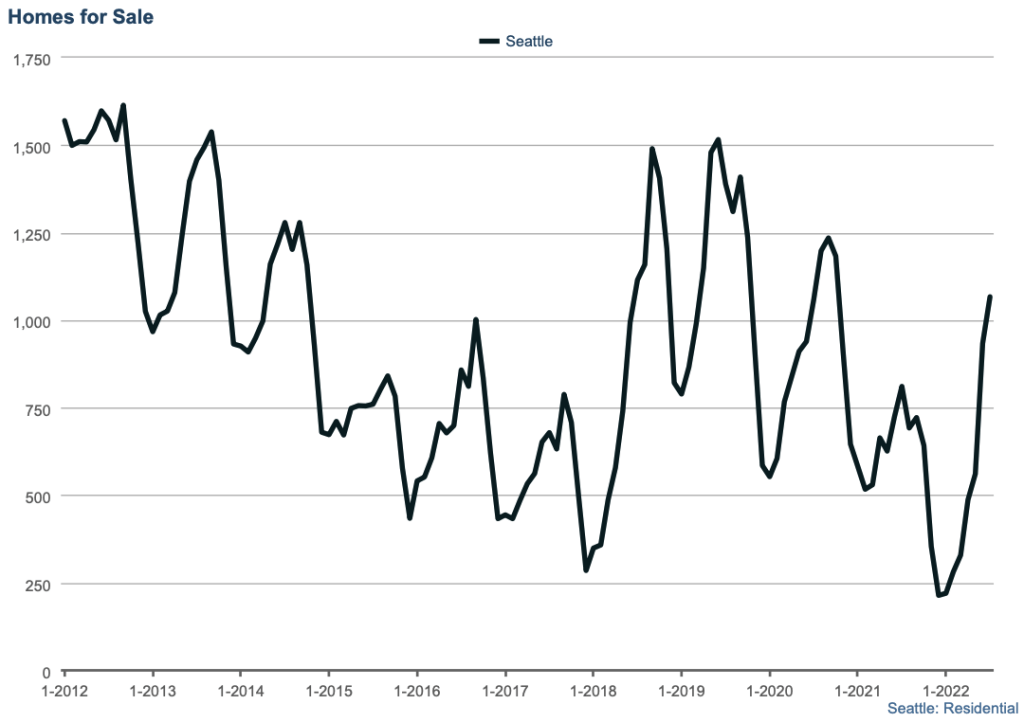

We ended July with 1,067 homes for sale. Looks like a lot given the slope of the graph below, but isn’t really.

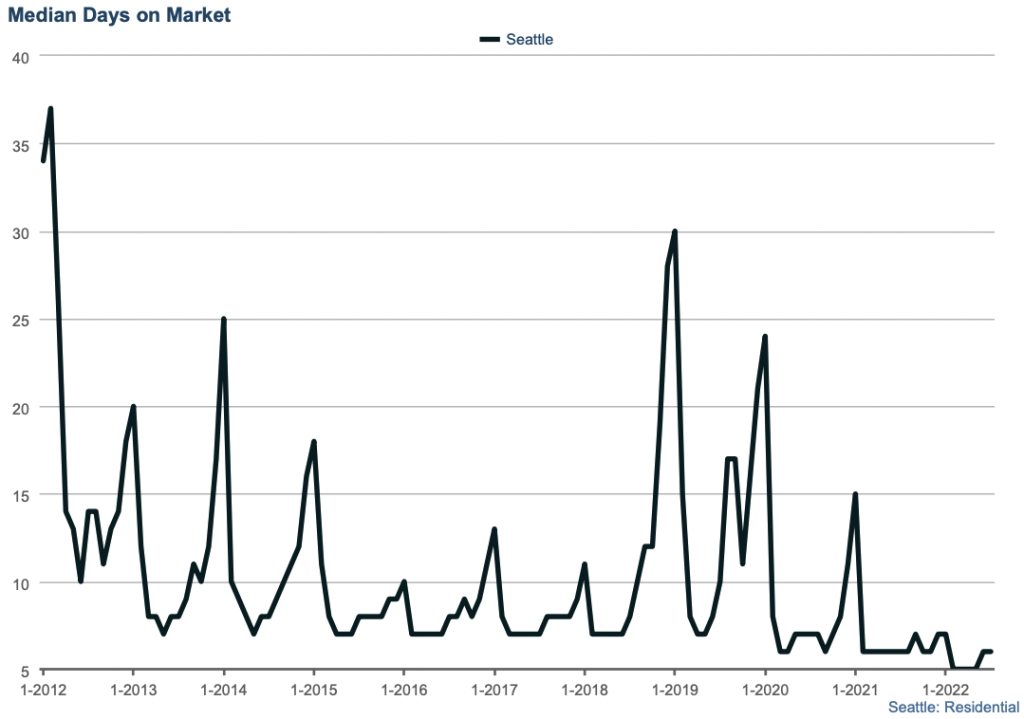

I was surprised to see that the days on market stayed flat at 6. How can that be!? It seems like so many homes are doing price reductions and staying on the market longer. I’m guessing that there is still a number of homes still moving quickly to balance those out.

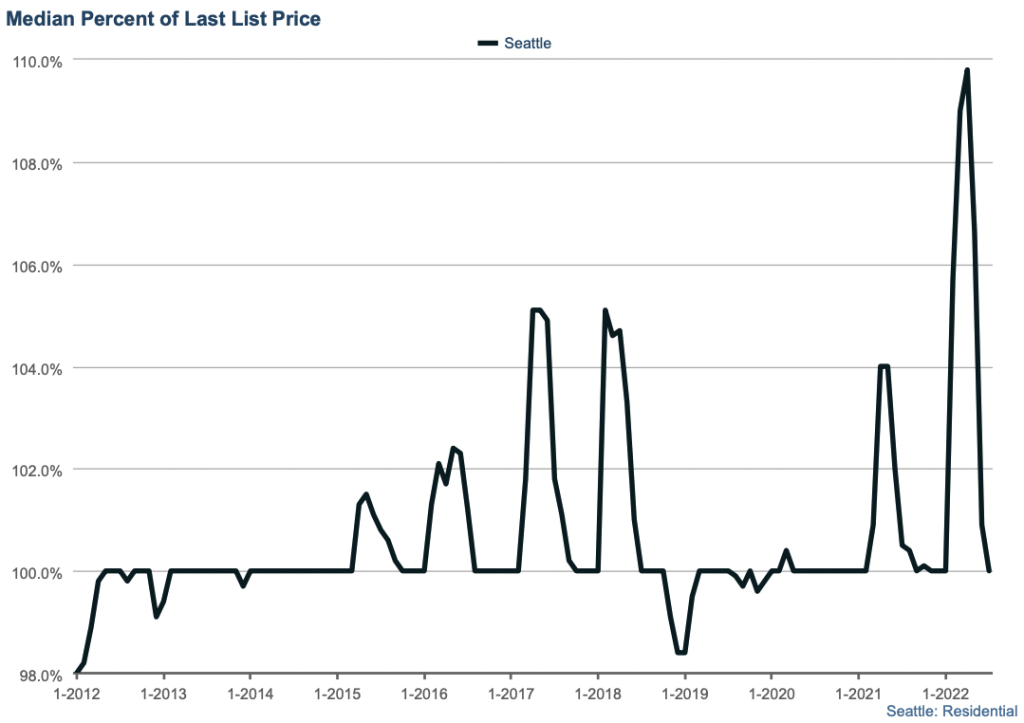

In July buyers were basically paying the list price for homes. I don’t think the graph below entirely tells that story though as some buyers are negotiating good discounts, but there are still some homes getting bidding wars. I expect that we’ll see the median percent of last list price to dip below 100% soon.

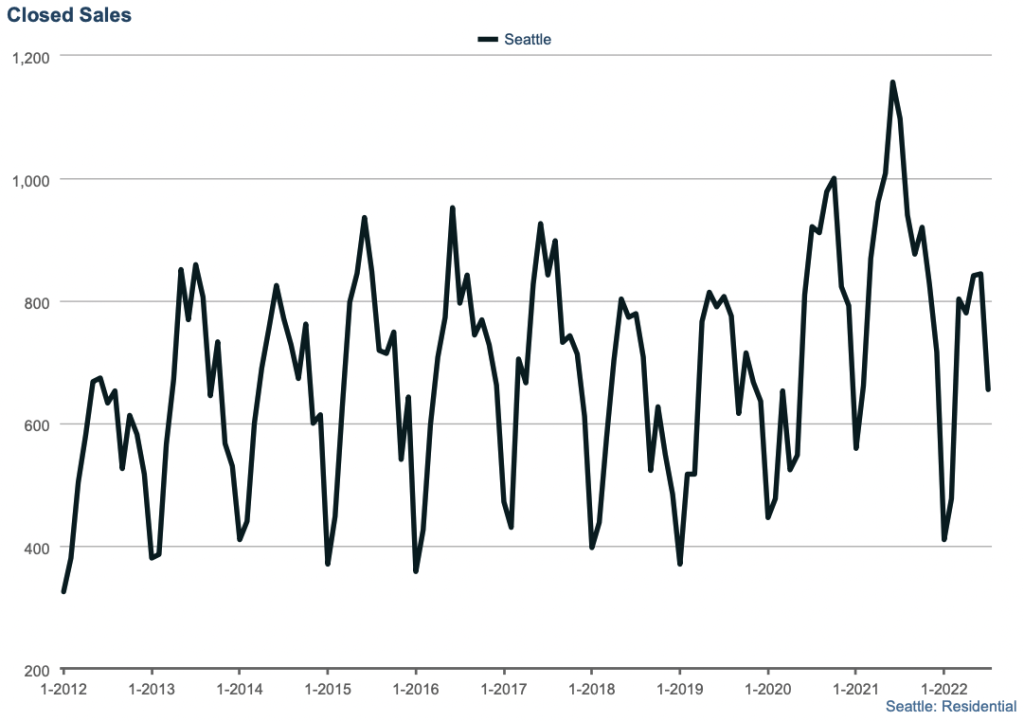

In July there were 655 closings making it the second slowest July for closings in the last ten years.

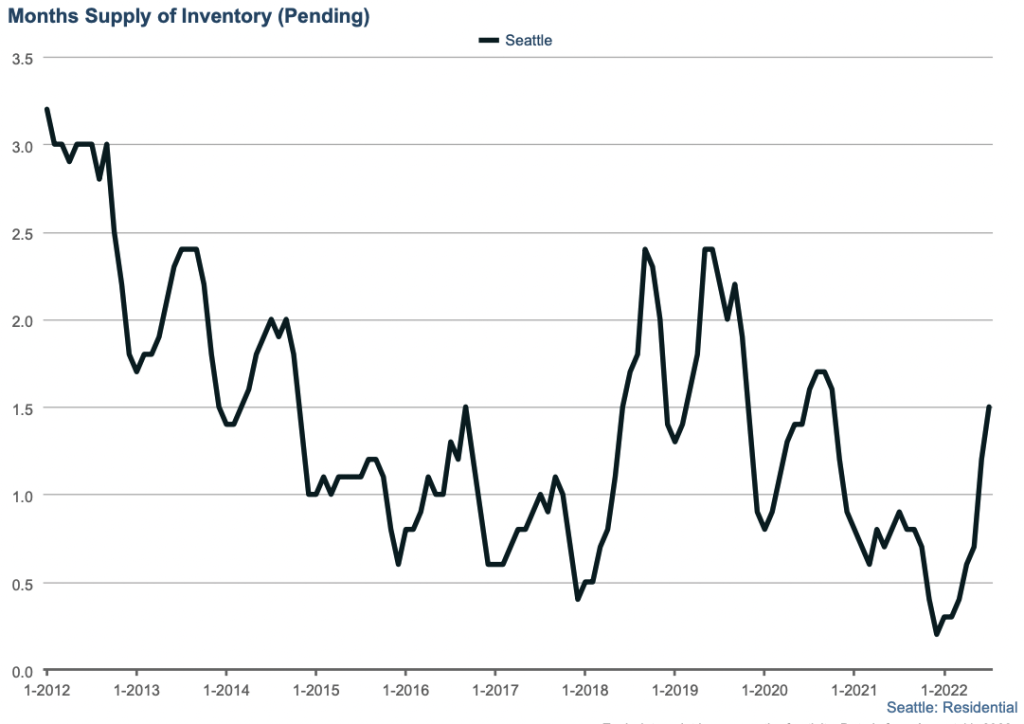

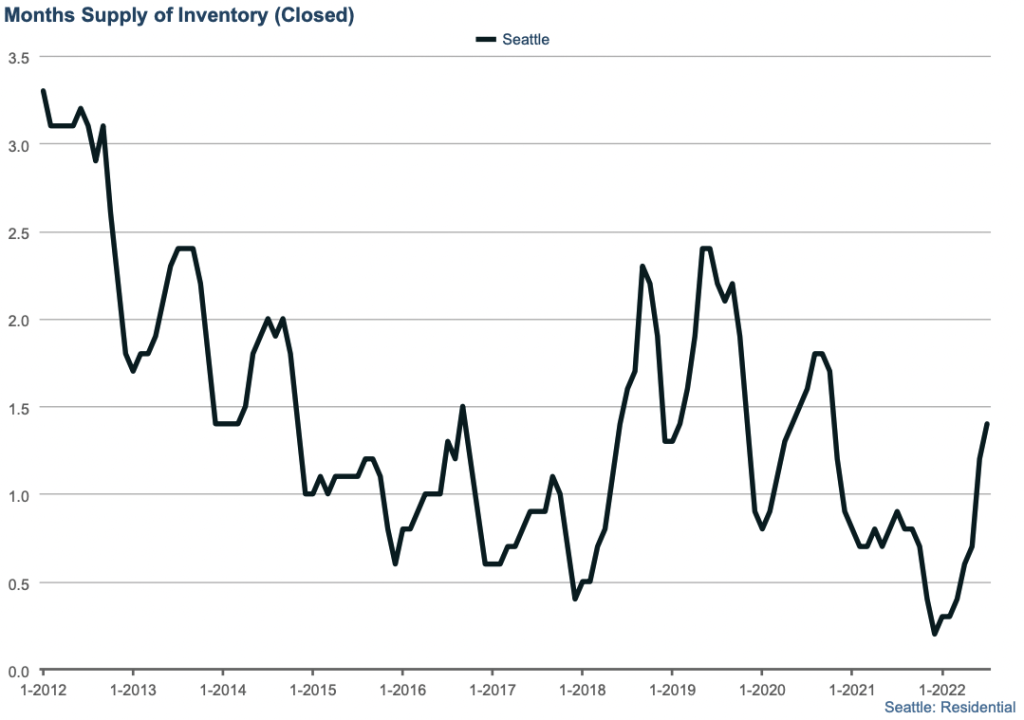

With the inventory of homes for sale growing, and buyers’ interest waning due to higher rates, it isn’t surprising that the months of supply, a measure of how long it’d take to sell all the homes for sale, is increasing. But we’re still far from a balanced market! (A balanced market is considered to be 3 months, which we haven’t seen in ten years!)

Looking for real-time updates on the market? Sign up for our weekly newsletter.