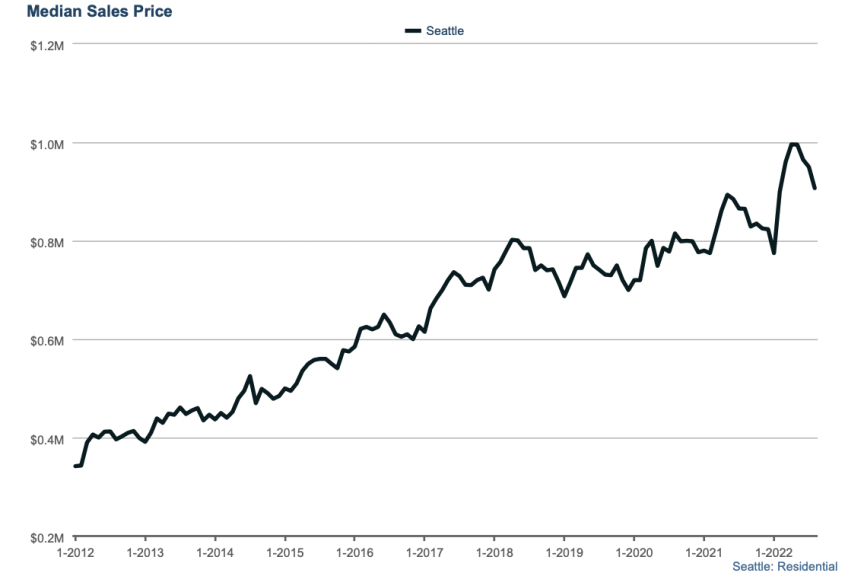

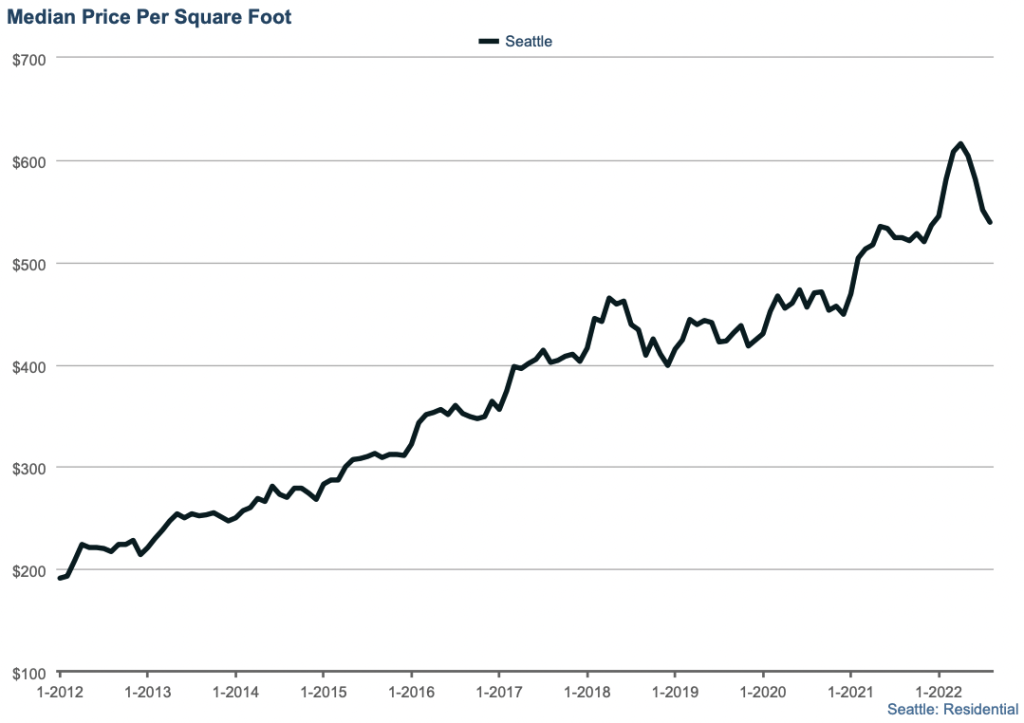

Seattle single-family August market report: median price down $90k from the peak, but still up y-o-y

The numbers for what the Seattle single-family and townhome real estate did in August are out. The headline is that the median price is now down nearly $90k from its May and April peak. However, prices are still up 4.9% year-over-year. Some of this price decline is seasonality, prices typically cool off in the back half of the year, but some of it is definitely the impact of higher interest rates and lower stock prices.

Here’s a deep dive into all the numbers.

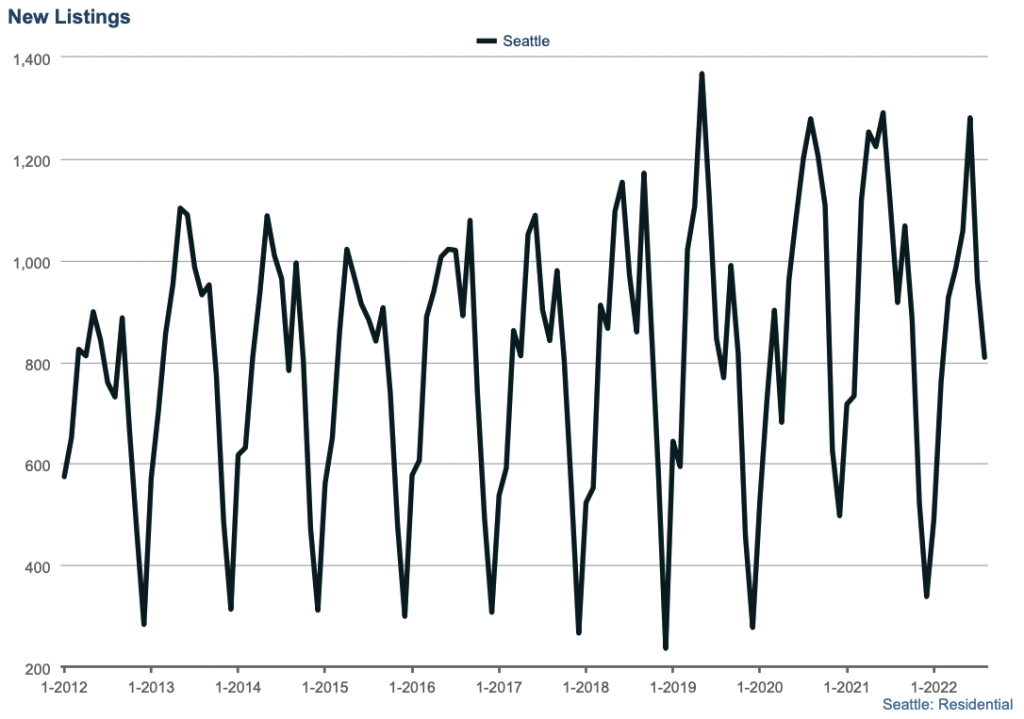

As we predicted, August was slow for new listings – buyers only saw 809 new listings compared to the 961 they saw in July. Definitely slower than the last couple of pandemic years, and even slower than the typical pre-pandemic August.

As we said last month, the month to watch is September… A big increase in inventory in September should lead to more price declines.

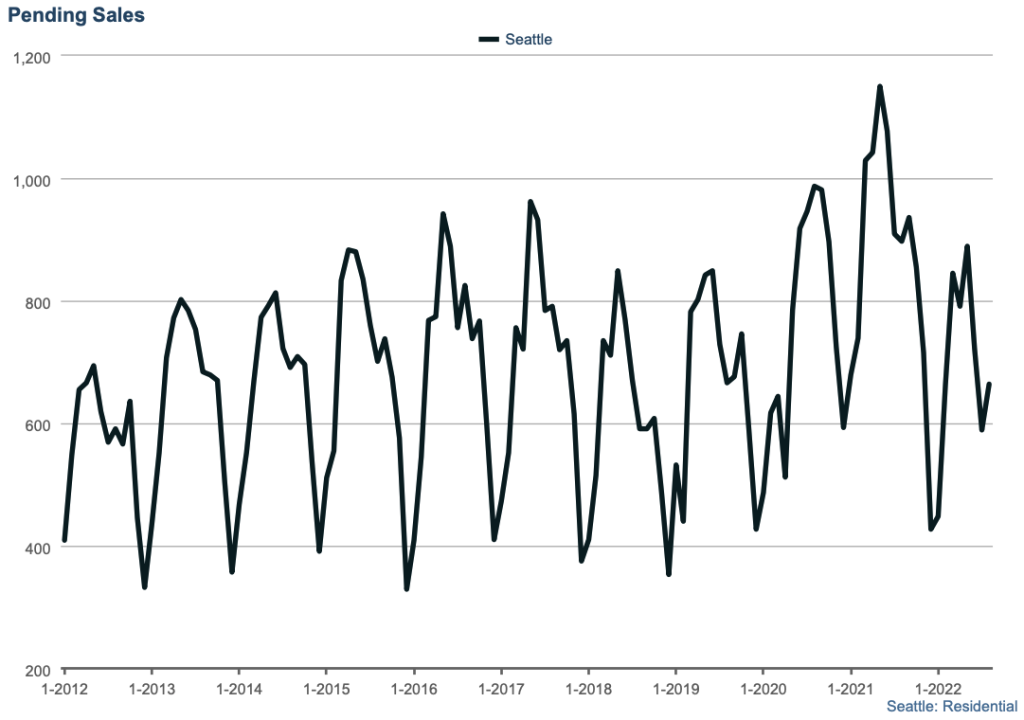

So sellers took a break in August. What about buyers? Buyers put 664 homes under contract, remarkably more than the 589 they put under contract in July. Was it because interest rates dipped in August? Or were buyers taking advantage of the slow month to try and score a deal? Definitely worth pointing out that pending sales were slow compared to pre-pandemic years.

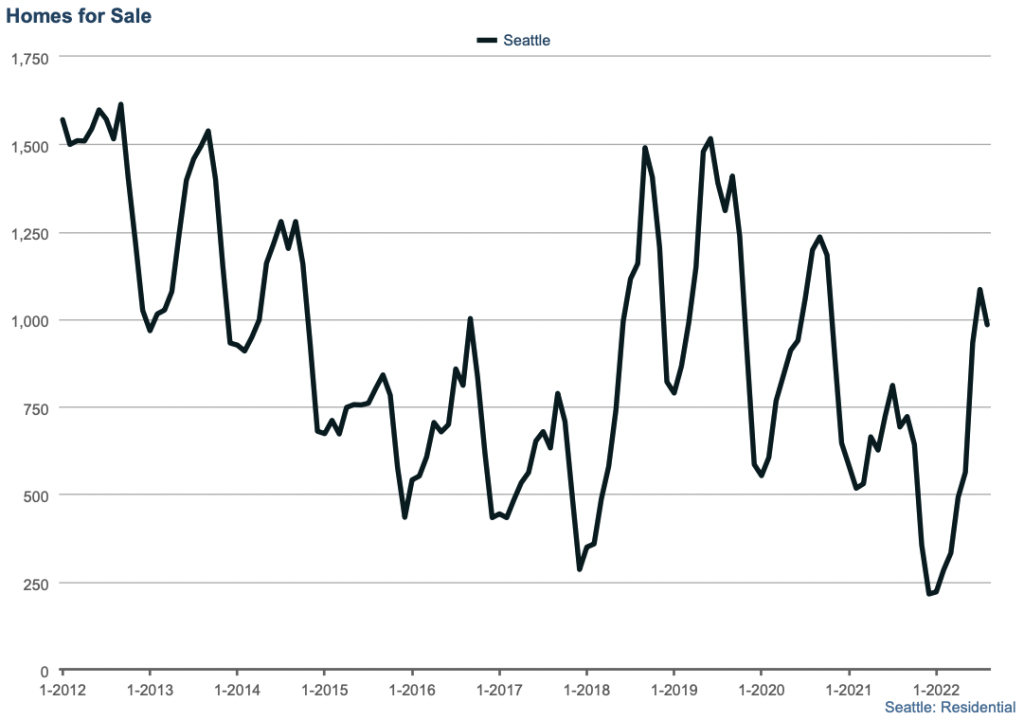

We ended August with 984 homes for sale, up from July’s 1,085 so there’s still a decent number of homes for sale. But for prices to really soften, we need to see the number of homes for sale increasing, not decreasing.

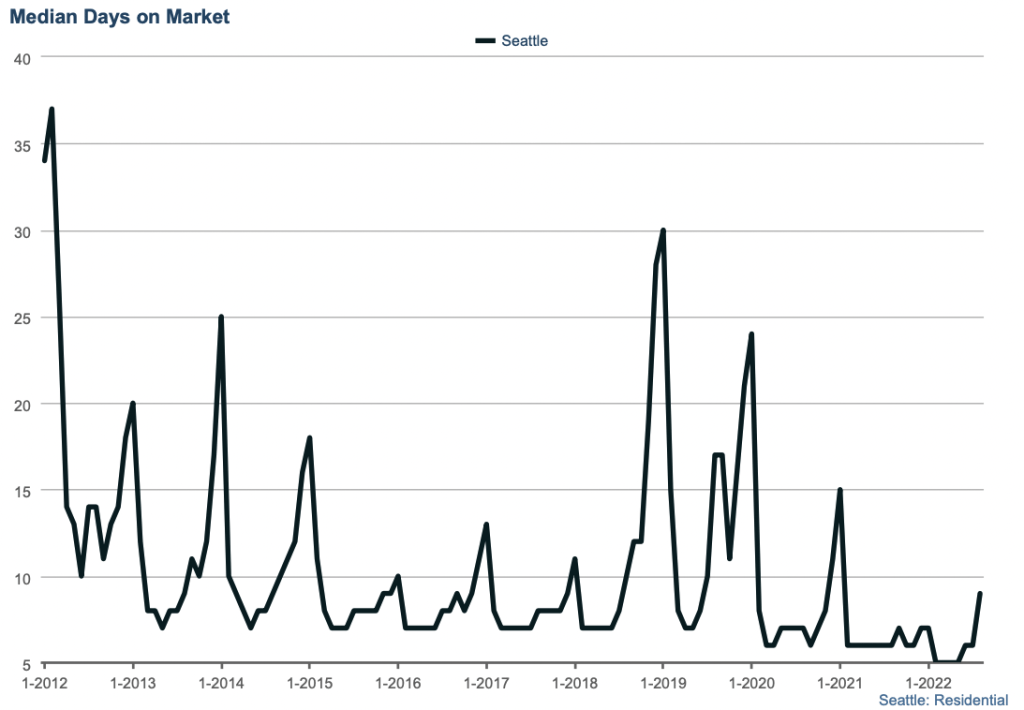

Finally, the market slowed with median days on market jumping from 6 in July to 9 in August. Expect the median days on market to continue to climb for the rest of the year. So sellers, give yourself more time to get your home sold. As we tell many would-be-sellers, the time to sell is in the spring.

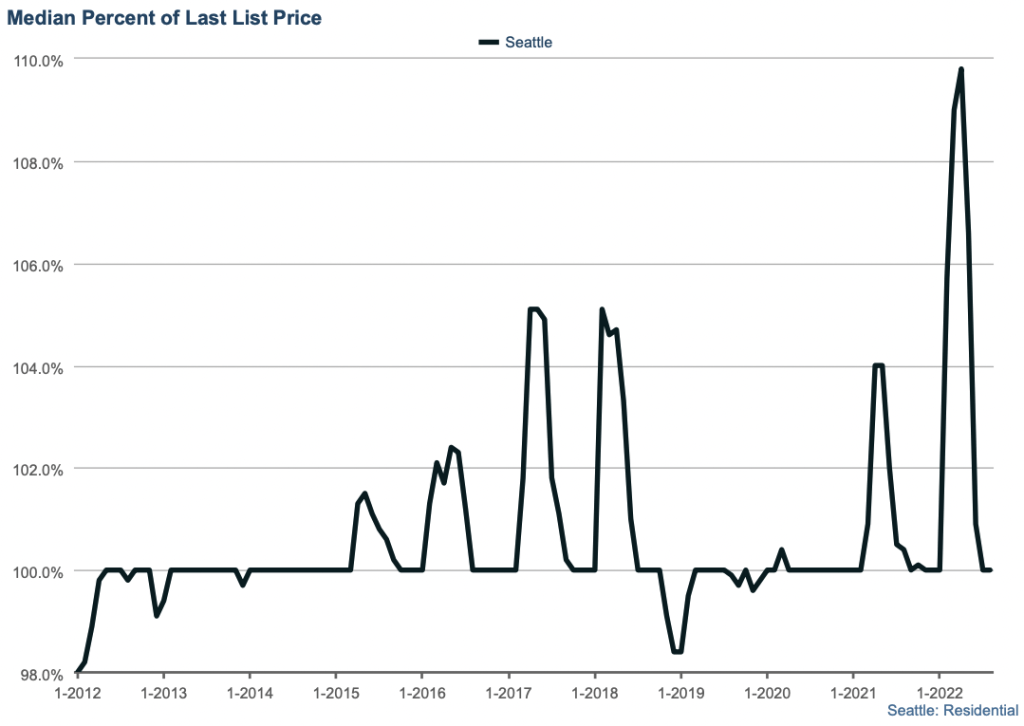

If days on market is increasing, you’d expect that the median percent of last list price would decline right? Right? Well, it didn’t. the median percent of last list price is 100%.

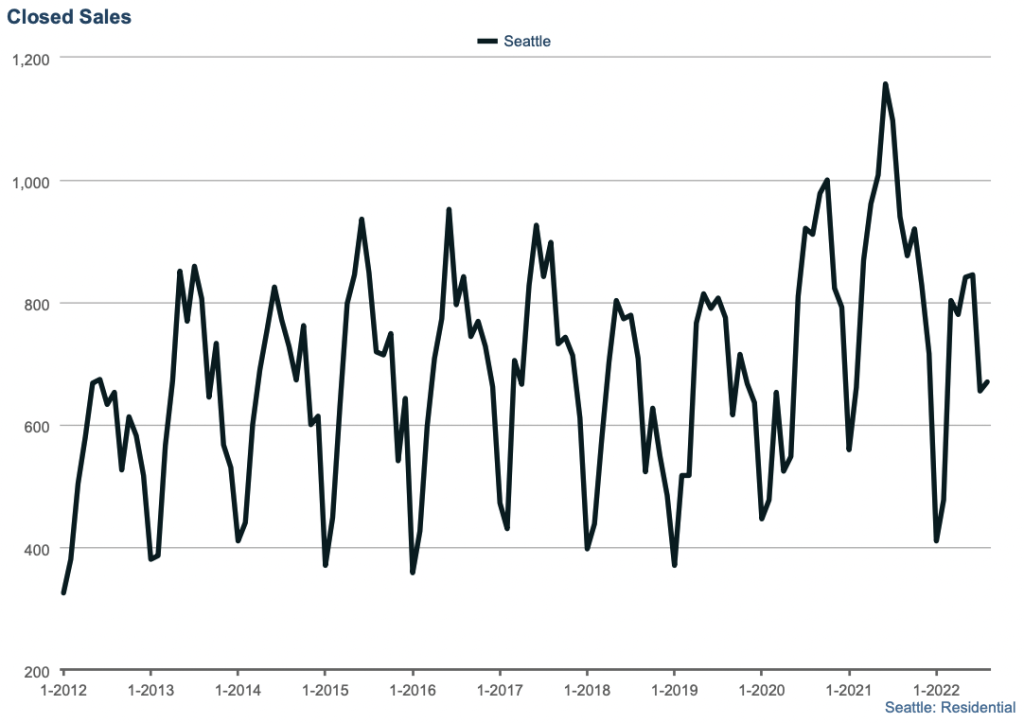

In August there were 670 closed sales making it one of the slower Augusts in terms of closed sales.

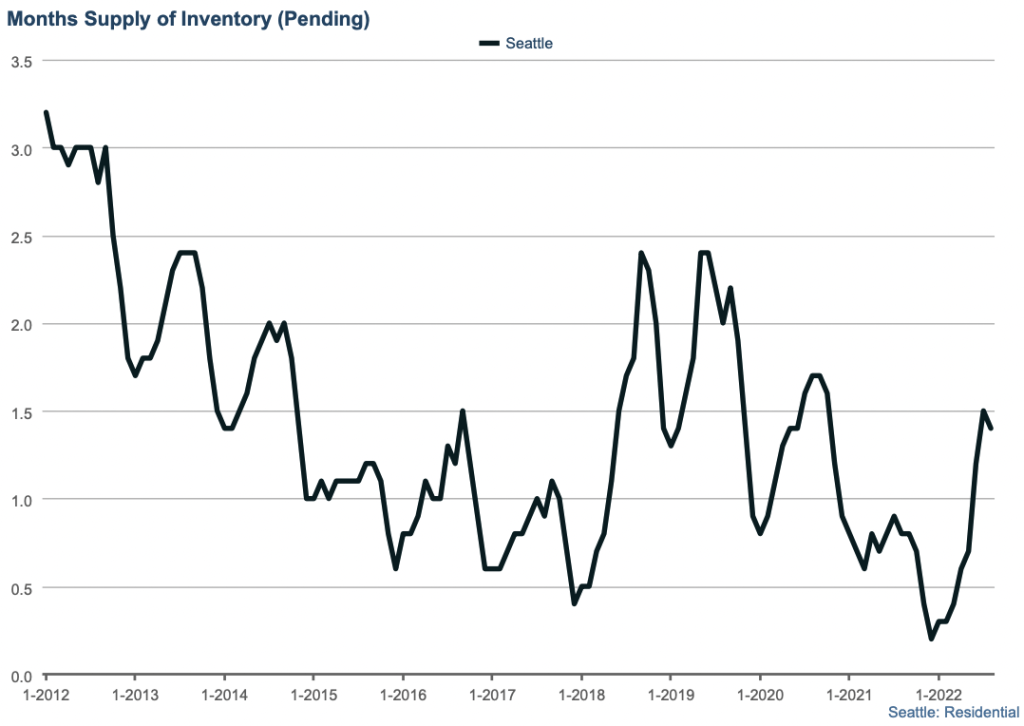

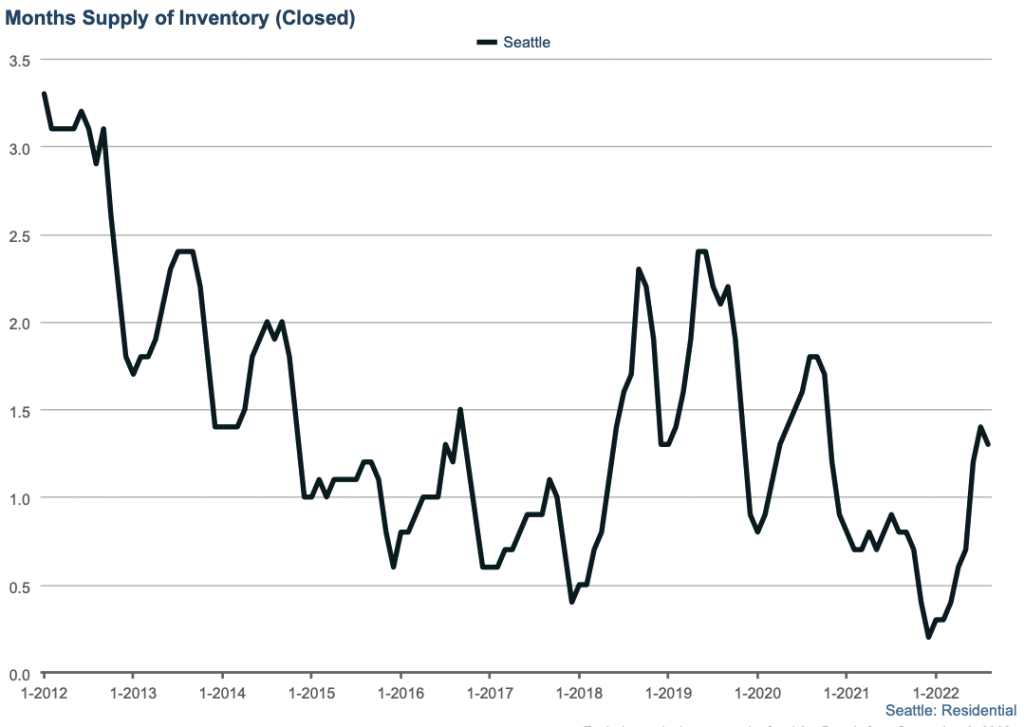

With the inventory of homes for sale declining it isn’t surprising that the months of supply, a measure of how long it’d take to sell all the homes for sale, is decreasing. But we’re still far from a balanced market!