Eastside single-family June market report: median price falls for the third month in a row

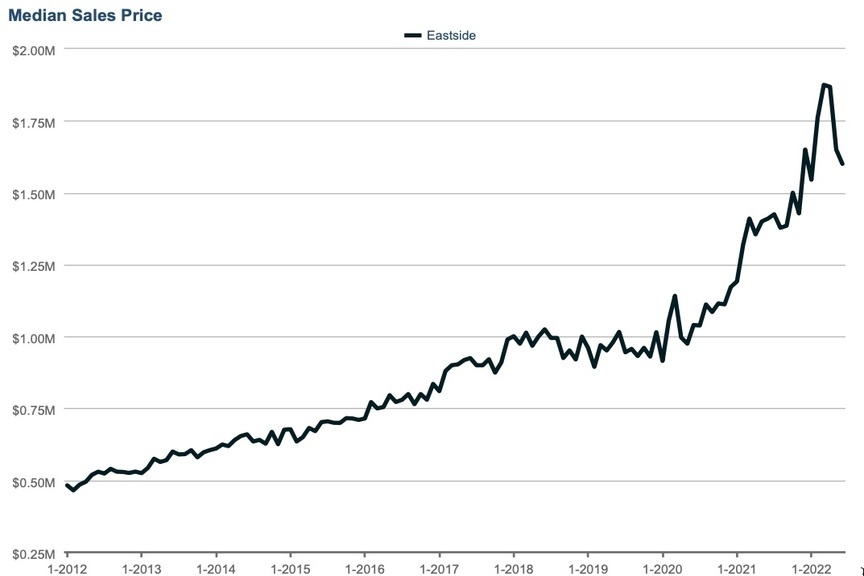

The numbers for how the Eastside single-family and townhome market did in June are out. The biggest headline is that median sales price fell for the third month in a row. This hasn’t happened since the spring season of 2009. This is due to historic low interests jumping to more normal rates amidst record high prices. The median sales price is still $190,000 above June of 2021. I expect we’ll see a couple more month of price decreases as rates above 5.5% becomes the norm and we hit the slowest months of the summer.

Here’s a deep dive around the other metrics from June:

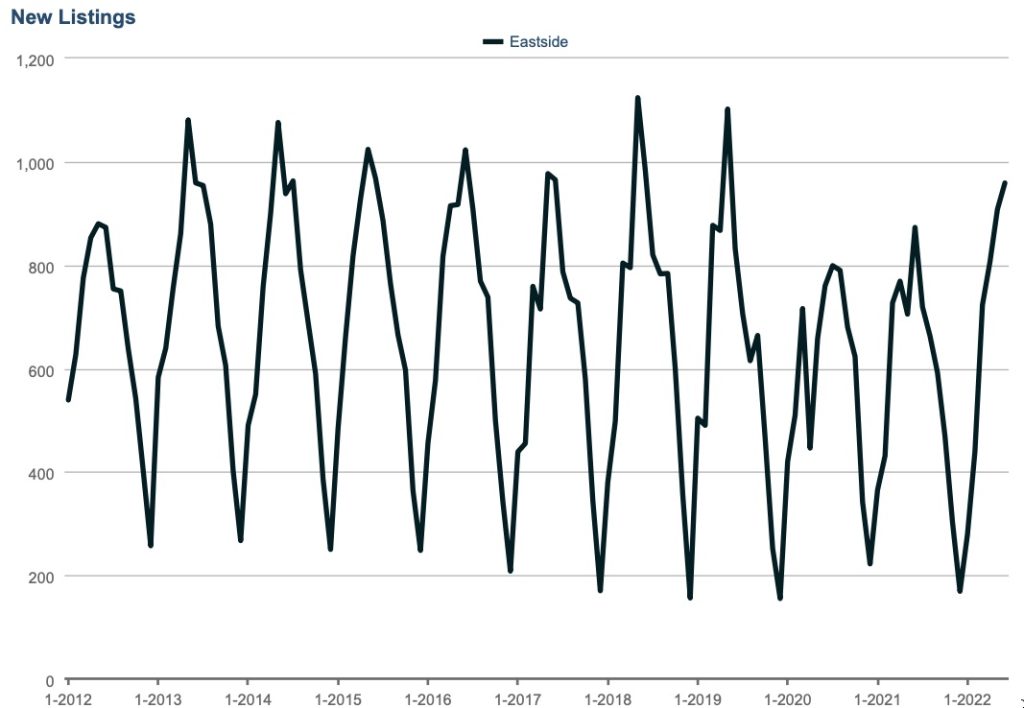

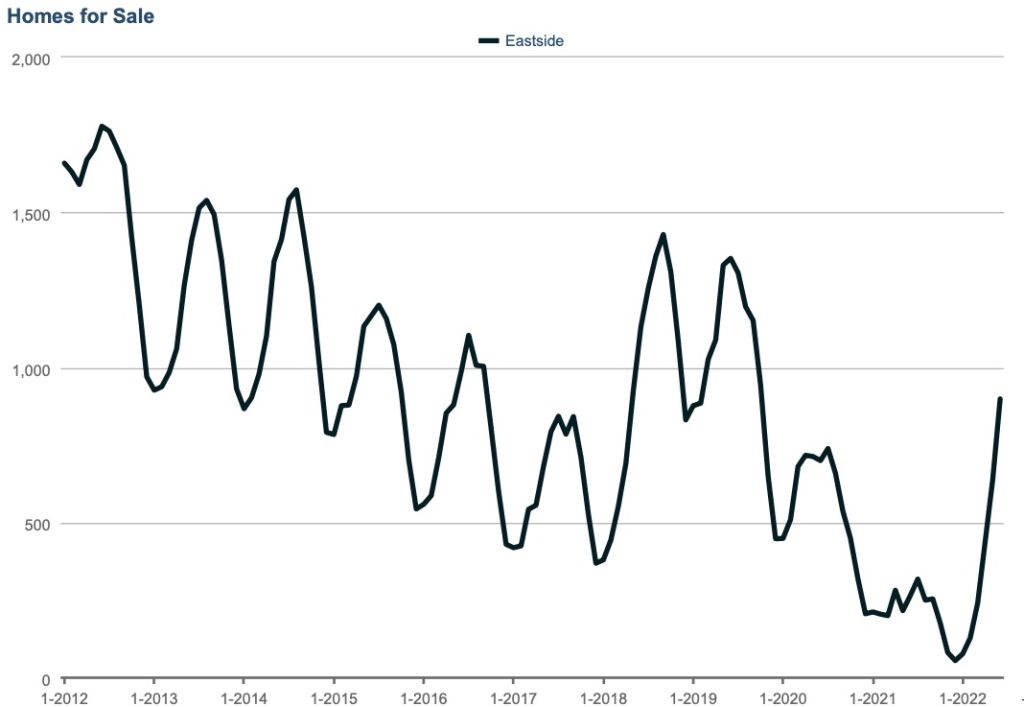

While it feels like there are a lot of listings on the market right now, I was surprised to see that there were only 960 new listings in June. That’s comparing to the inventory starved market of the last few years. June was the highest month for new listings since may of 2019.

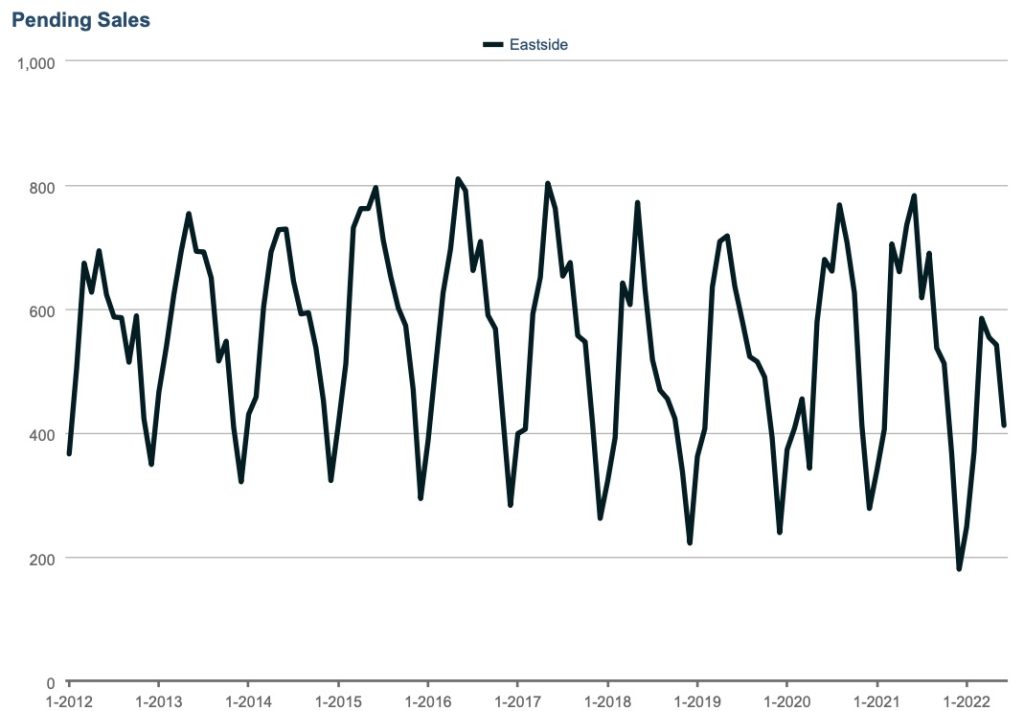

More listings means more competition amongst sellers which is good news for buyers. The really bad news for sellers in June is that only 410 homes were put under contract, a 32% drop from the 542 pending sales in May.

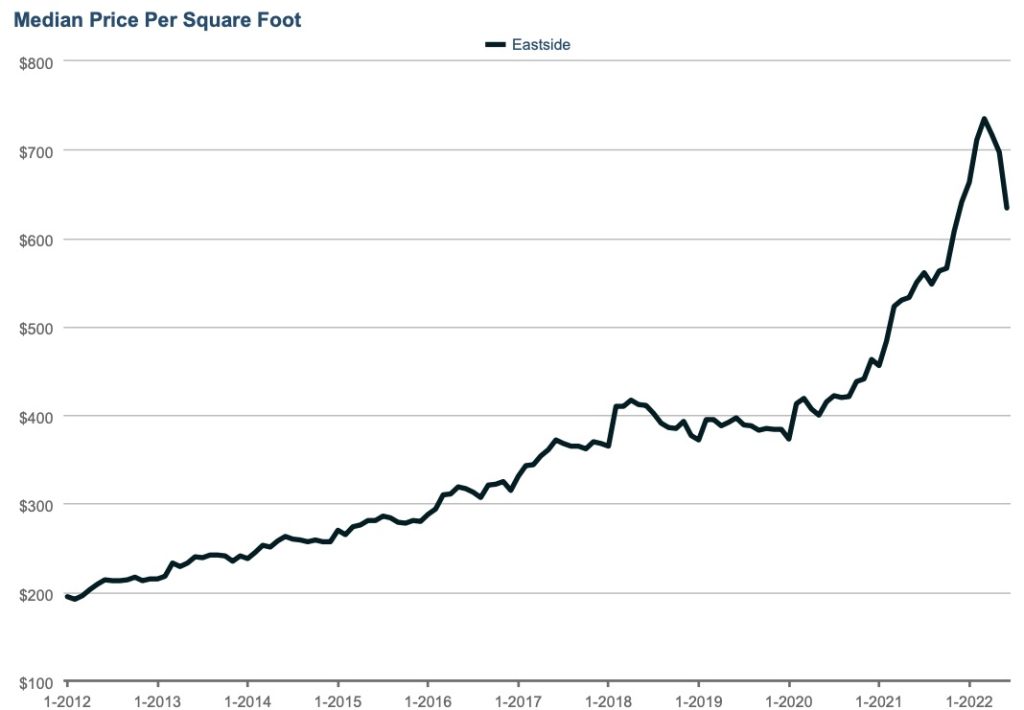

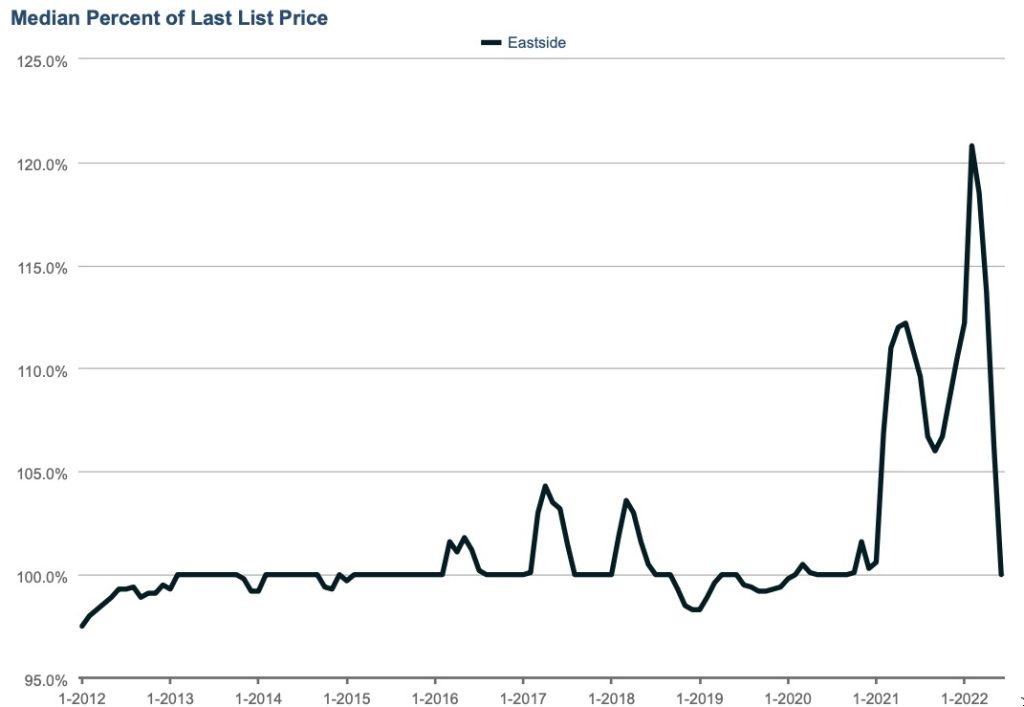

More listings and fewer buyers means much less competition amongst the buyers that are still active. If you can believe it, median home escalations (as measured by the percent above list price homes are selling) was 0% in June. We have to go back to January of 2021 to see that!

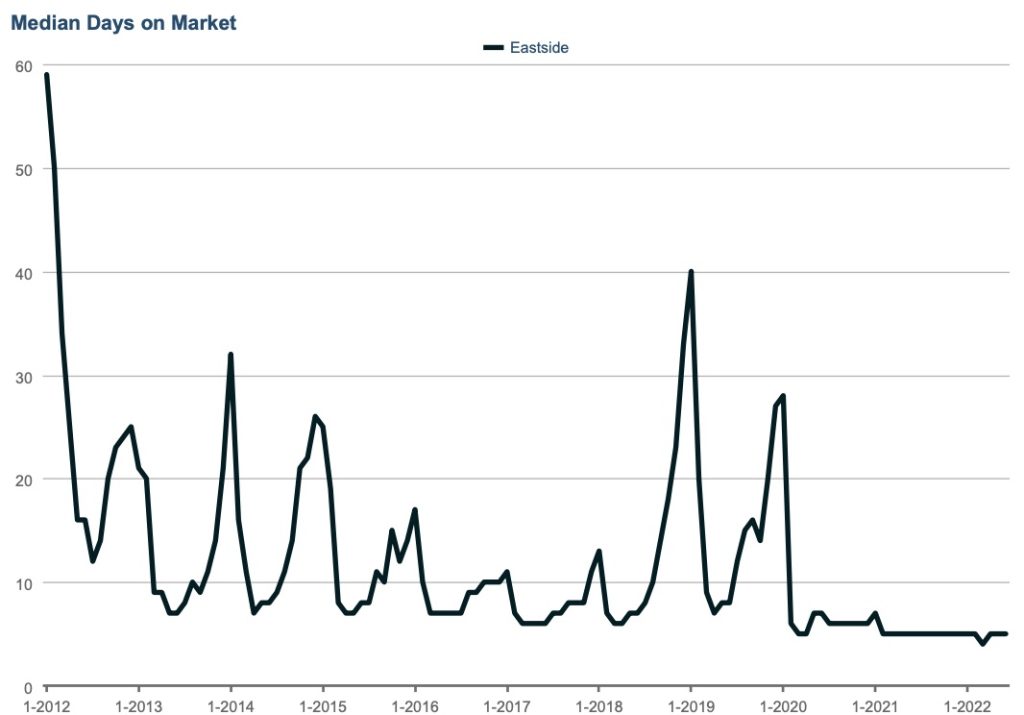

One surprising number is that days on market has NOT increased yet. I expect this is due to the lag in data – closed homes in June went under contract in May which was still hot. Days on market will increase in next month’s report.

We ended the month with 903 homes still for sale, nearly equal to the number of new listings in the month of June. We haven’t seen that since October of 2019.

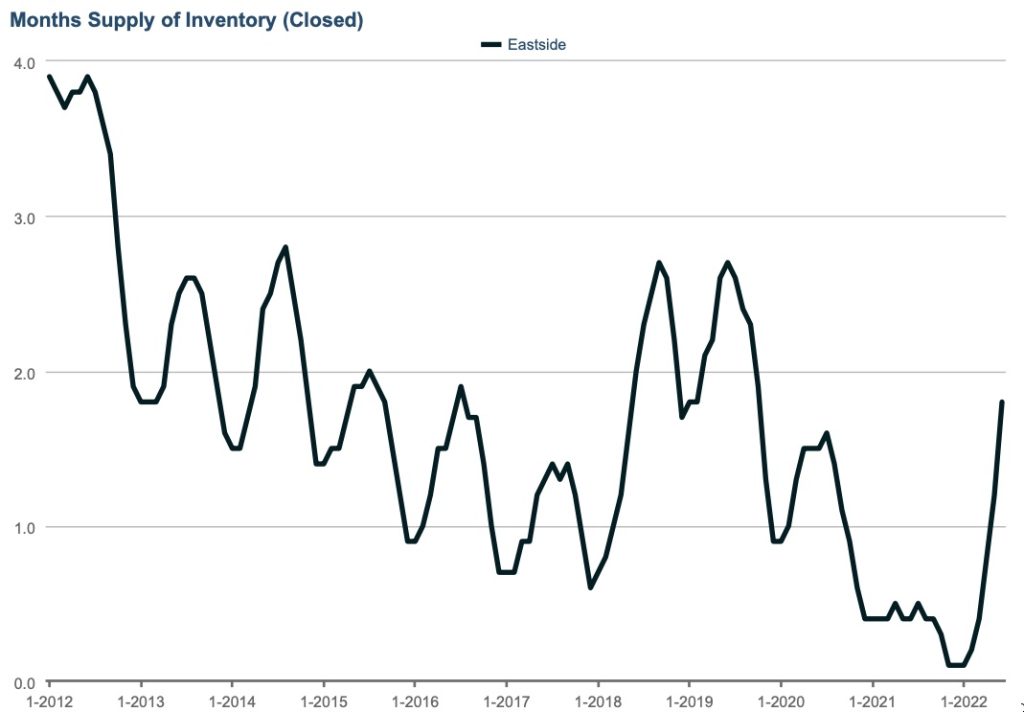

As you can probably feel, we’re getting closer to a balanced market on the Eastside but we’re not there quite yet. Months supply of inventory, a measure of how long it would take to sell out of the current supply, is sitting at just below two months (a balanced market is three months). This is the high water mark since October of 2019.