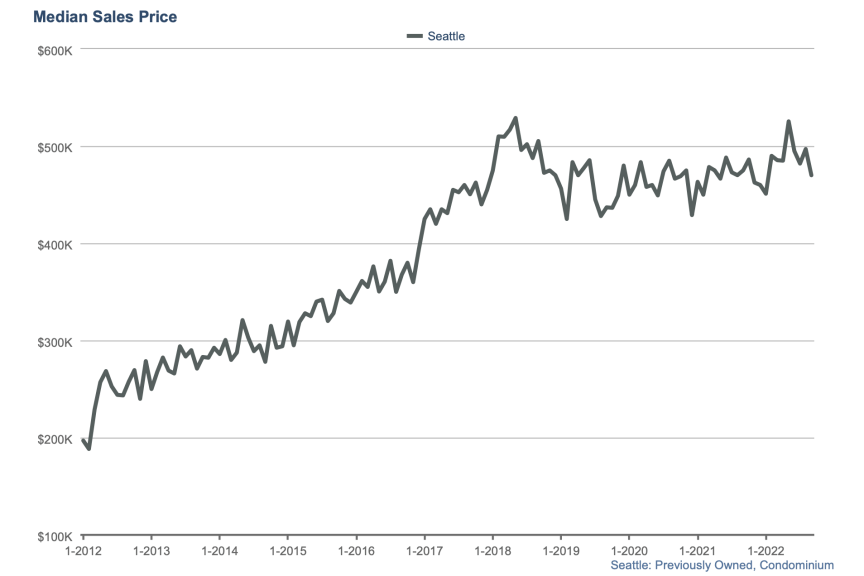

Seattle condo market report: condos down 11% from peak

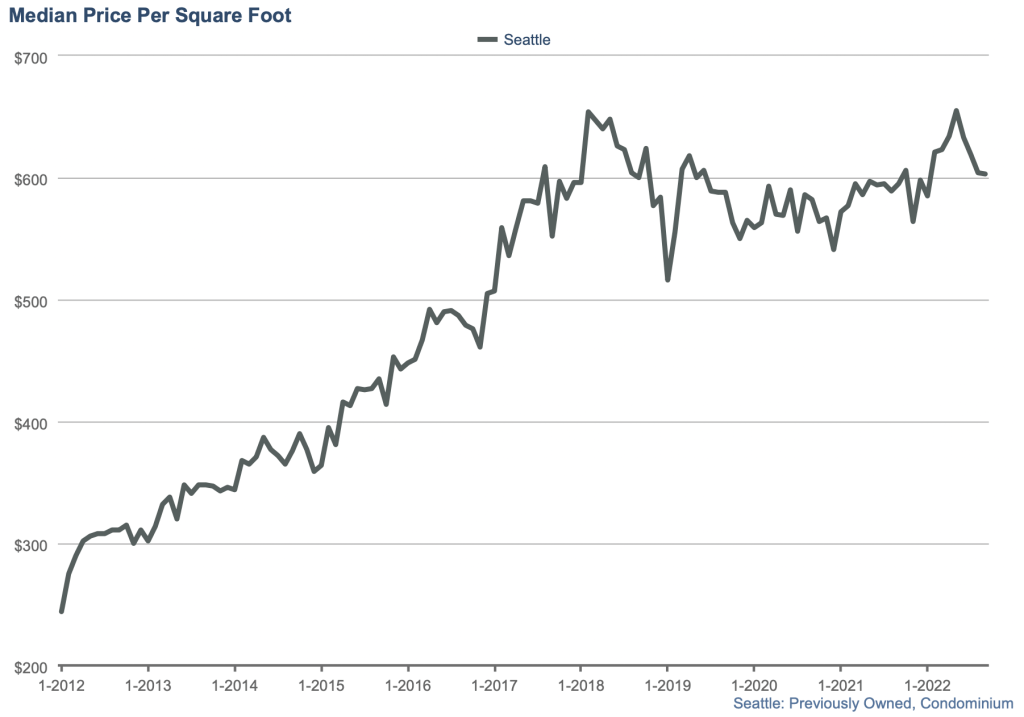

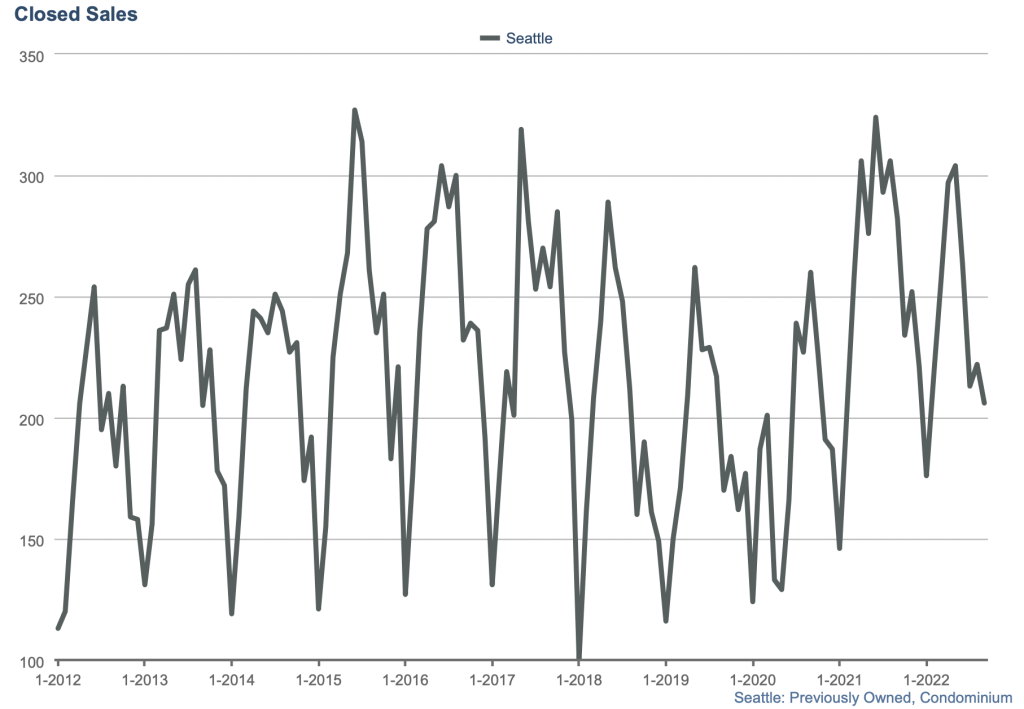

The numbers for what the Seattle condo market did in September are out and the headline is that the median price declined month-over-month to $470,000 putting it 11% off of the peak in May when it was $525,000. Some of this price decline is seasonality, prices typically cool off in the back half of the year, but some of it is definitely the impact of higher interest rates (mortgage rates are 7% today, last year at this time they were 3.2%) and lower stock prices (a lot of tech buyers in Seattle need to sell their company’s stock for their down payment).

Here’s a deep dive into all the numbers.

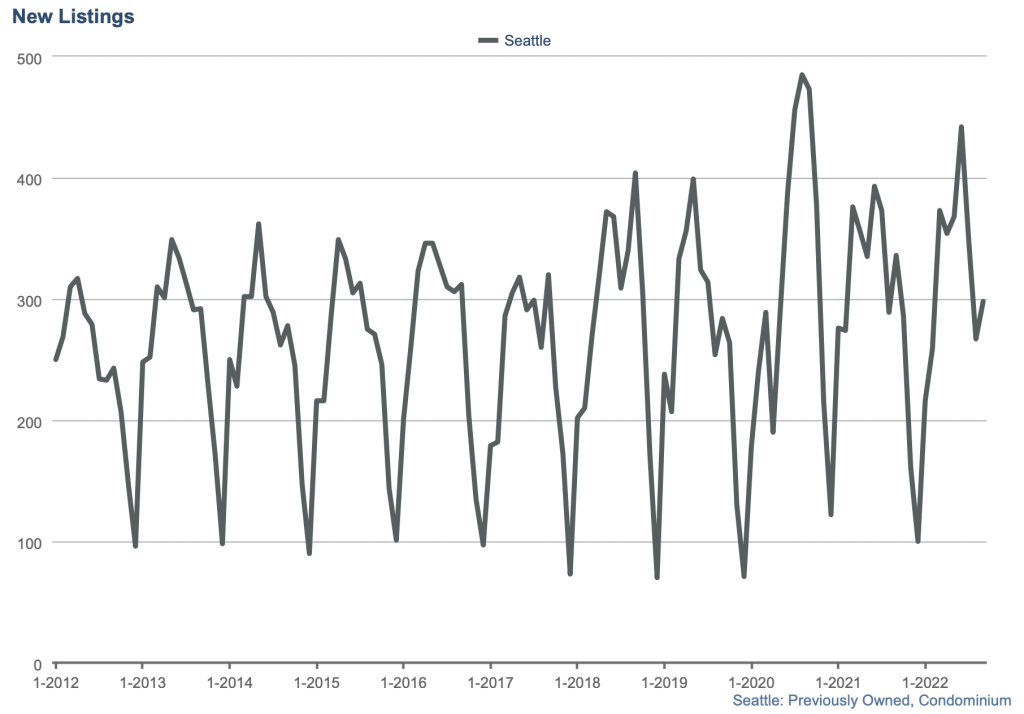

In September buyers saw 298 new listings, up from 267 in August. August is typically a slow month for new listings and in September we usually see a post-labor day bump in new listings. Expect to see the number of new listings to decline in October, November, and December; we won’t see the rate of new listings increase until January. Also expect that this fall we may see fewer new listings than usual as listing agents counsel sellers who don’t need to sell immediately, to wait until 2023 since so many buyers are hitting on their searches.

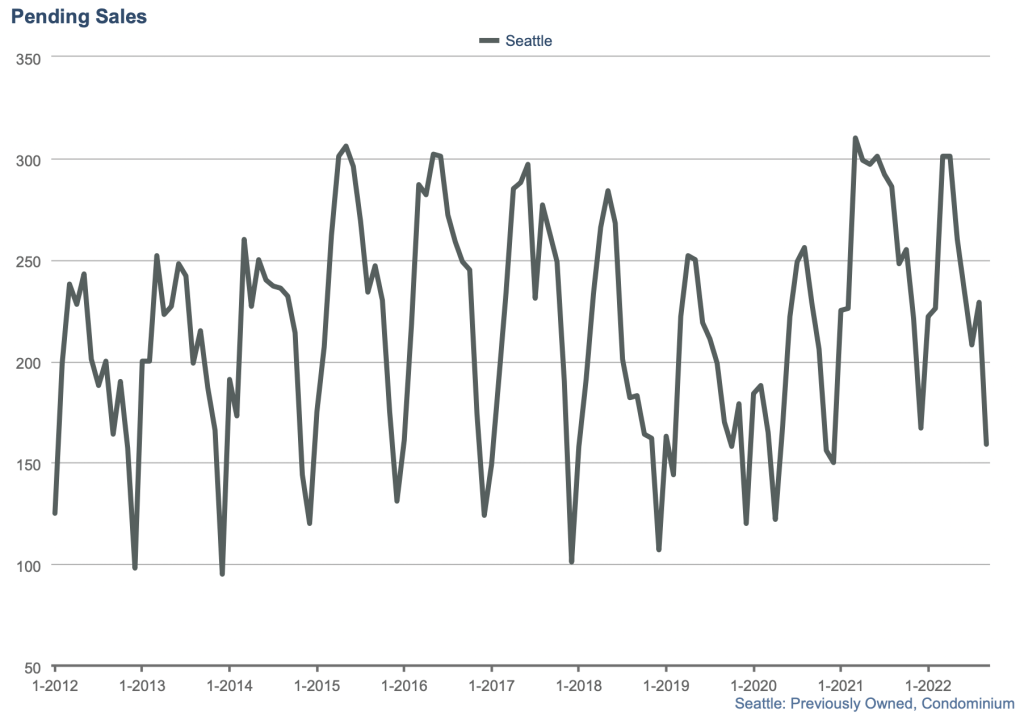

Buyers only put 159 condos under contract in September. Given that September had more new listings than August, we would have expected to see the number of pendings in September to be higher than August. Clearly, interest rates and the stock market are taking their toll on buyers.

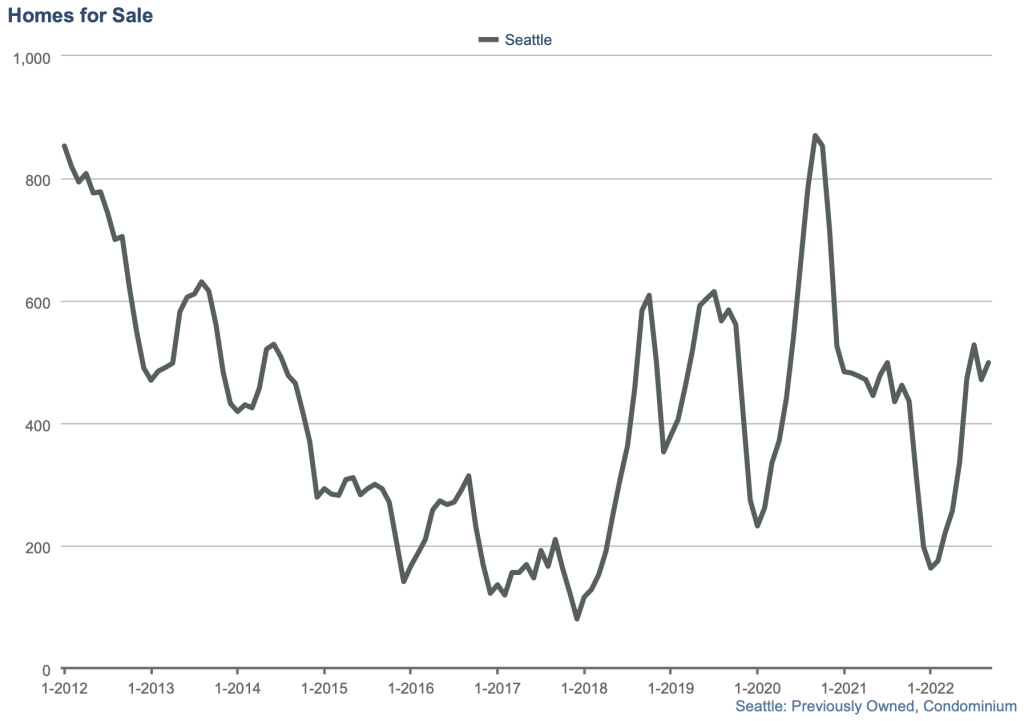

The number of homes for sale at the end of September was 499, an increase from the 471 we saw at the end of August.

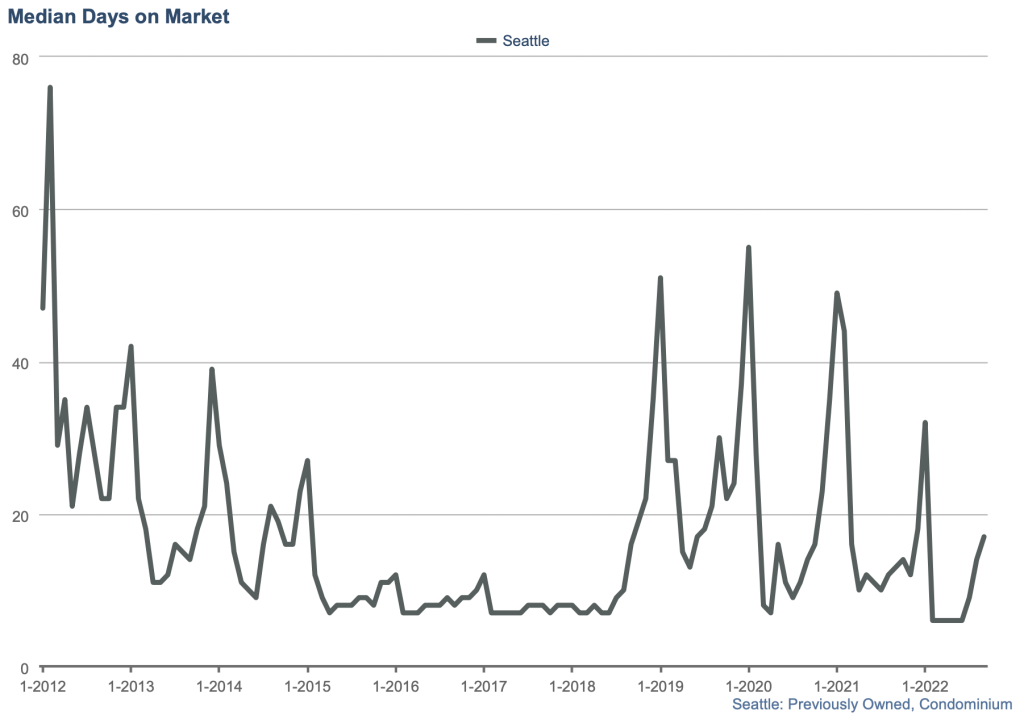

The median days on market increased to 17.

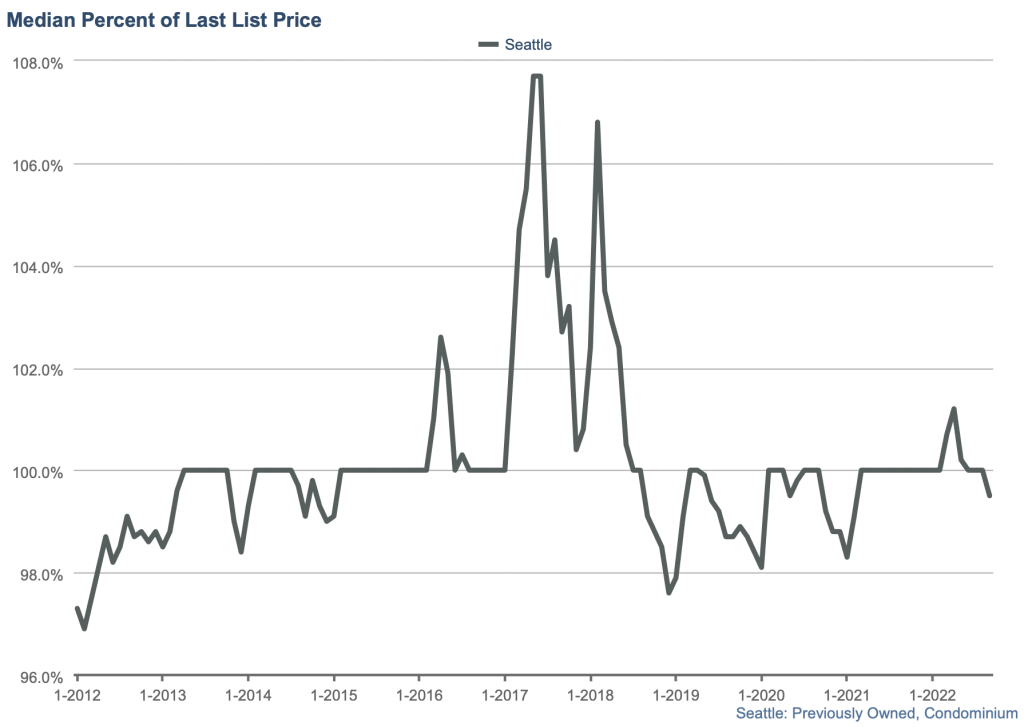

Condos are now selling below their list price.

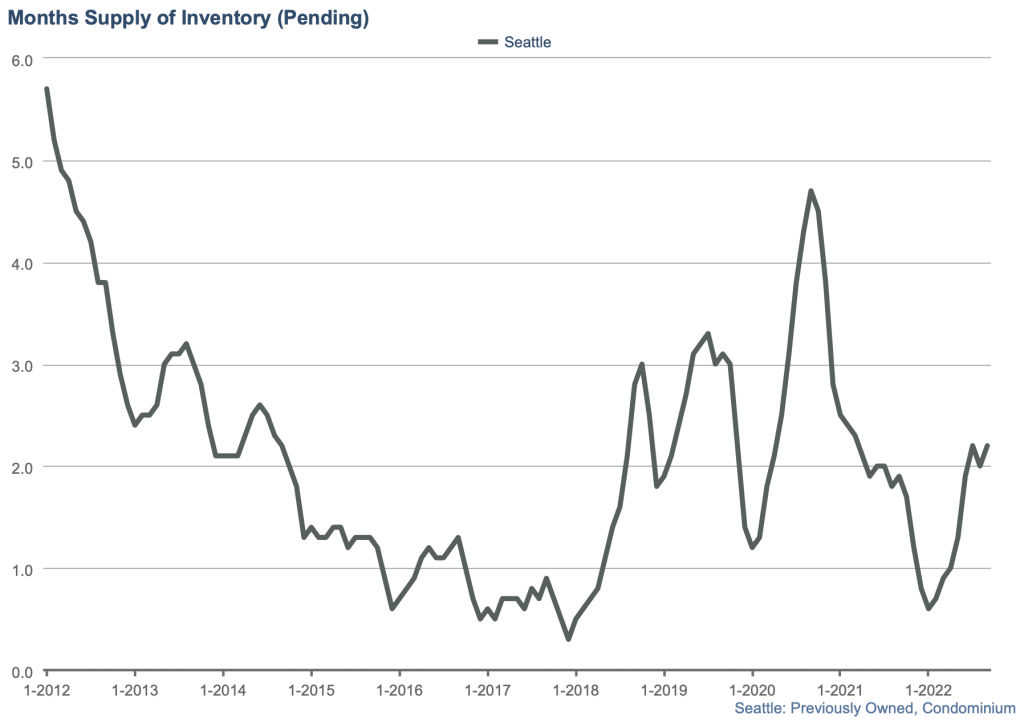

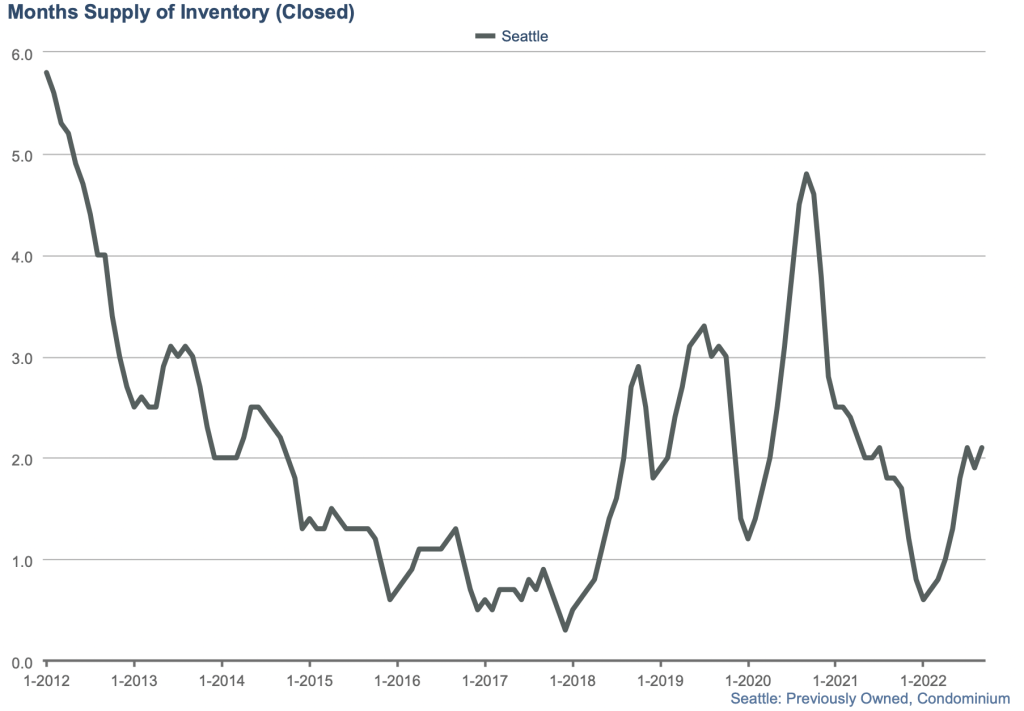

With the inventory of homes for sale increasing and buyers hitting pause, it isn’t surprising that the months of supply, a measure of how long it’d take to sell all the homes for sale, is increasing. But we’re still far from a balanced market!