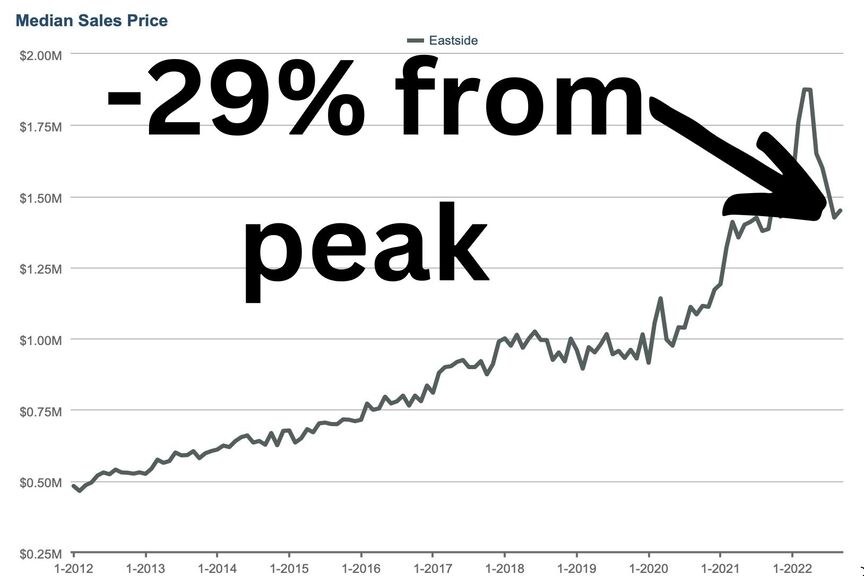

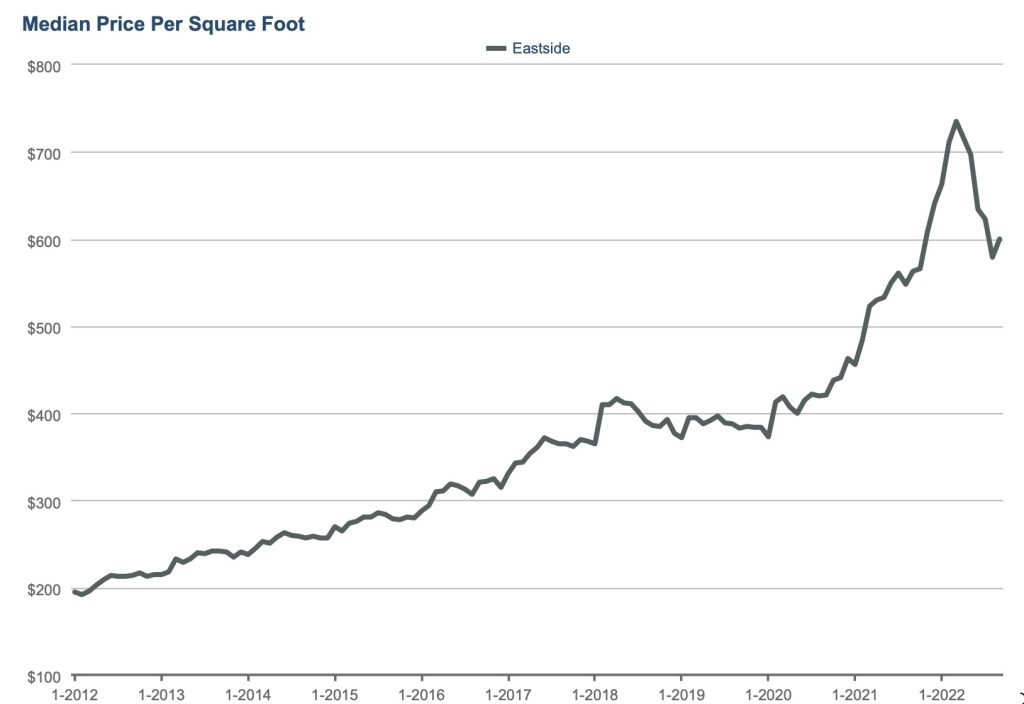

Eastside single-family September market report: median price down 29% from the peak, but still up 5% y-o-y

If you’re trying to figure out what the real estate is doing right now, you’re not alone! In an interesting twist, median sales price is up 2% month-over-month, breaking a five month fall. Since the peak in March, home prices have fallen a whopping 29%, or $425,000(!!) but are still up 5% over this time last year. The continued drop in prices on the Eastside can be attributed to rising interest rates (7% this month) and a struggling stock market.

Here’s a look into all the numbers:

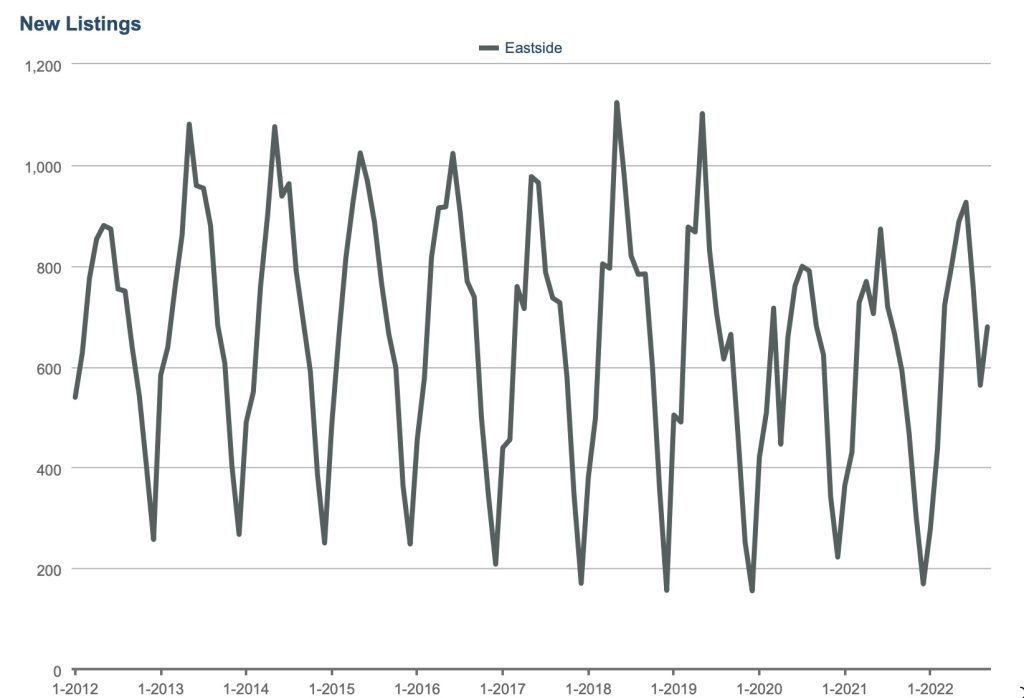

New listings climbed upwards in September with 679 homes hitting a market, a 25% increase over August. This was expected as August is usually the slowest month of the year but the 25% increase is a bit surprising. Sellers flooded the market to try and catch the handful of buyers still out there who aren’t pausing their searches in the face of interest rates. Expect the number of new listings to drop through the end of the year as sellers get counseled to wait until the spring if they can.

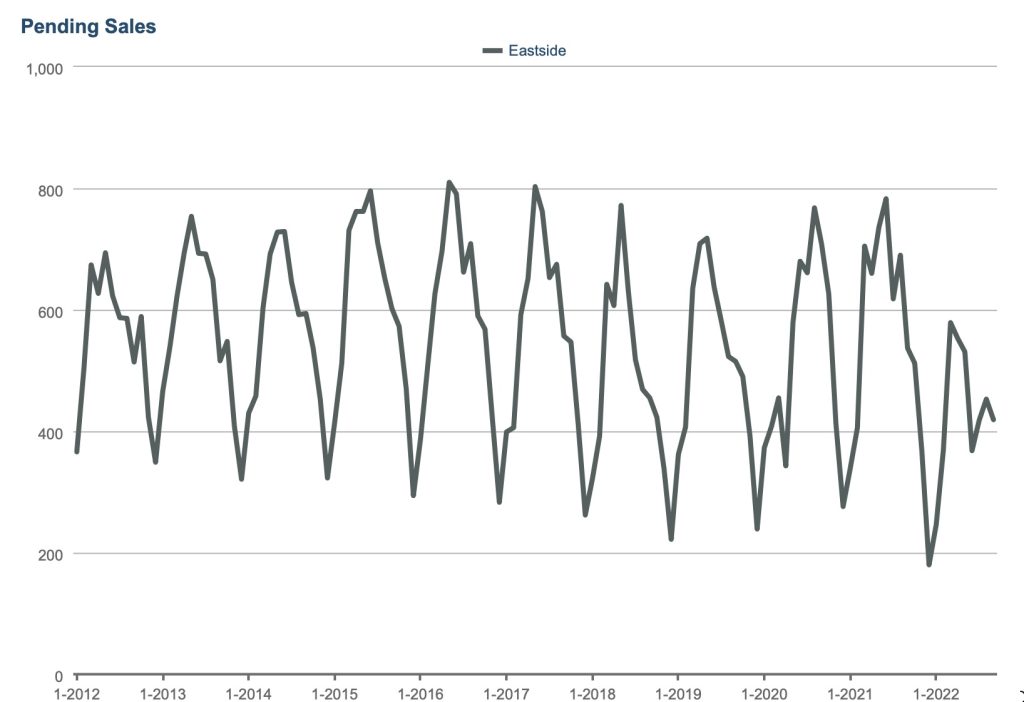

Conversely, pending sales dipped 8% month-over-month with 419 homes going under contract. Even though the low was in June and buyers have options in the inventory, the interest rates and stock market are still having an impact on buyer confidence.

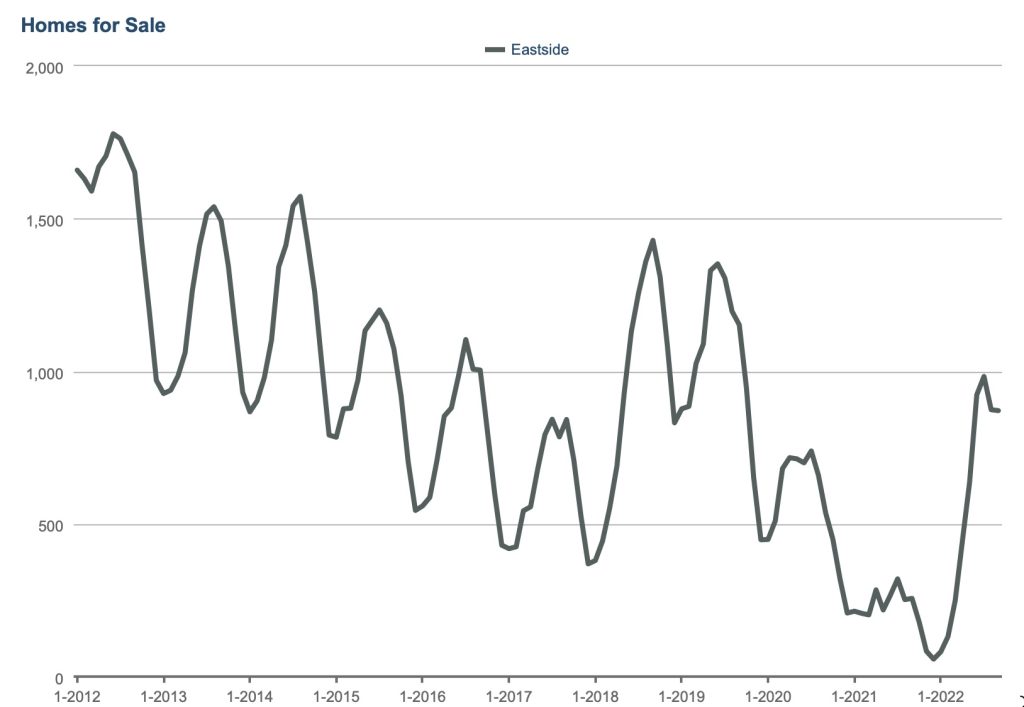

We ended the month with 871 of homes for sale. The amount of inventory remained flat from August to September but we can expect this to drop along with new listings each month for the rest of the year.

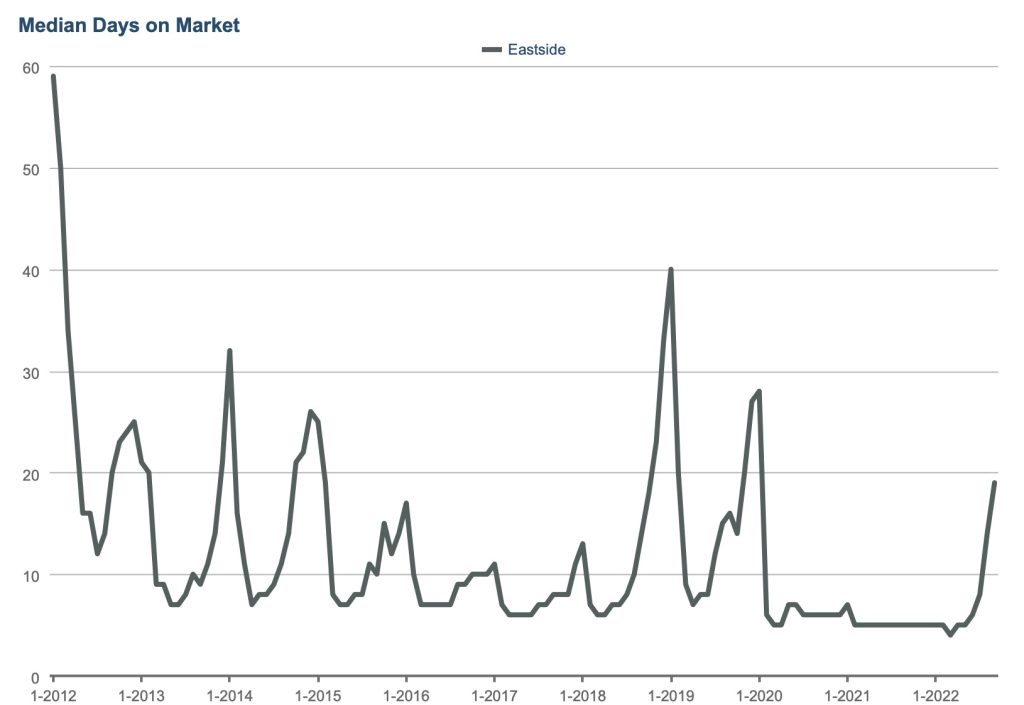

With buyers taking a pause from their search and the market usually slowing down in the fall, sellers should not be expecting their homes to sell quickly. Homes are spending a median 20 days on market right now on the Eastside. Make sure you and your listing agent are pricing your home correctly right now!

Median percent of list price is now below 100% for the third month in a row. The buyers that are out there are finding deals and very rarely are we seeing multiple offers.

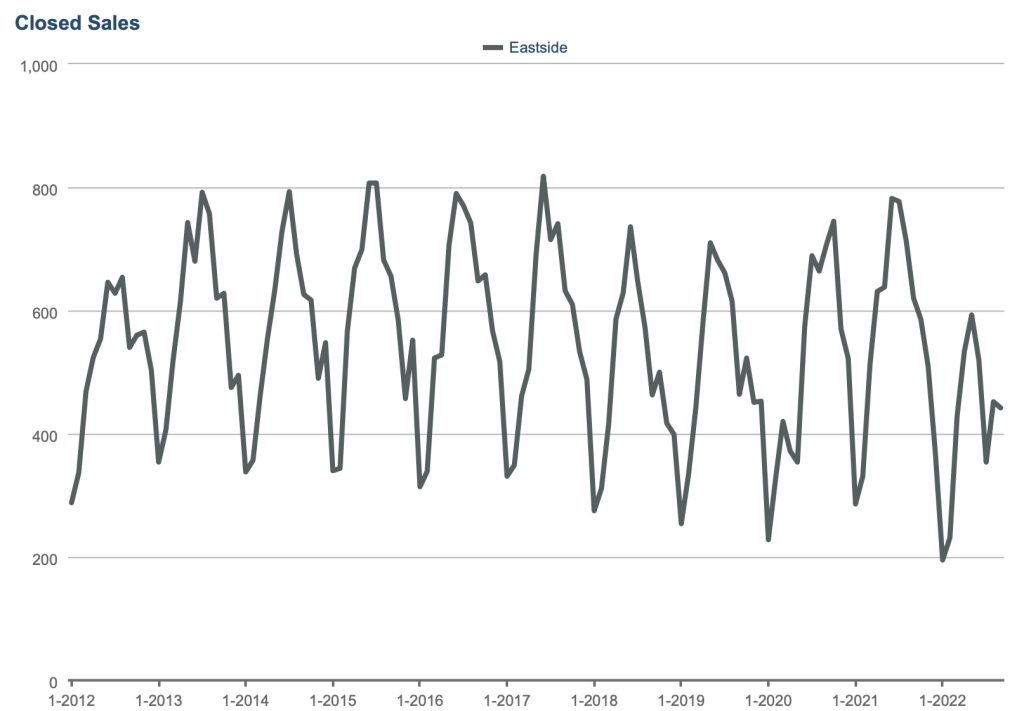

We saw 442 closed home sales in September, a result from the 452 homes that went under contract in August primarily.

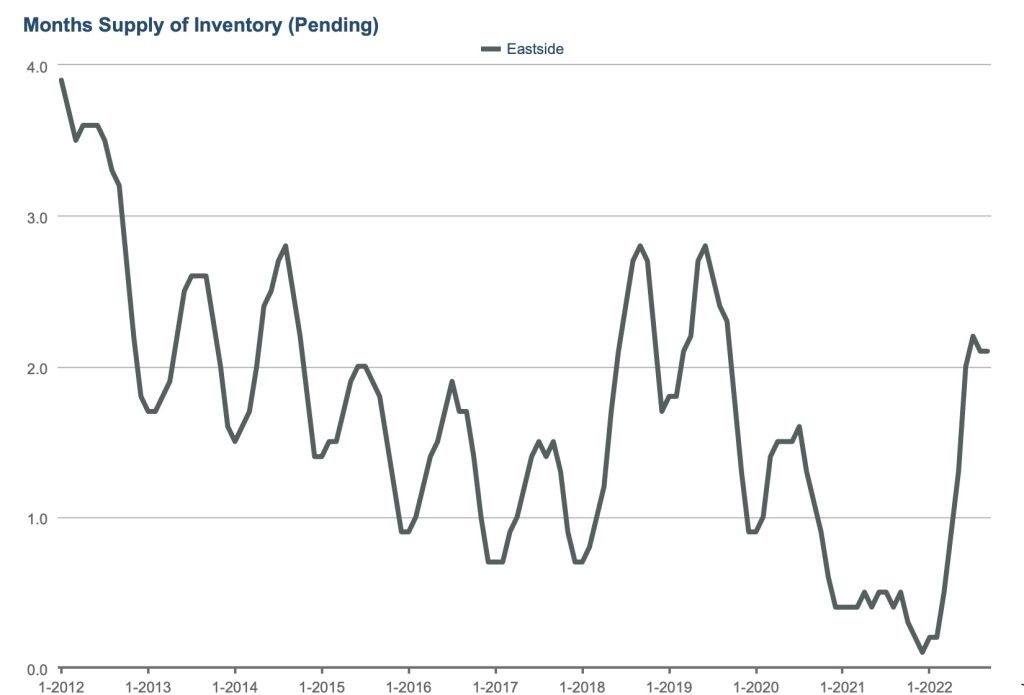

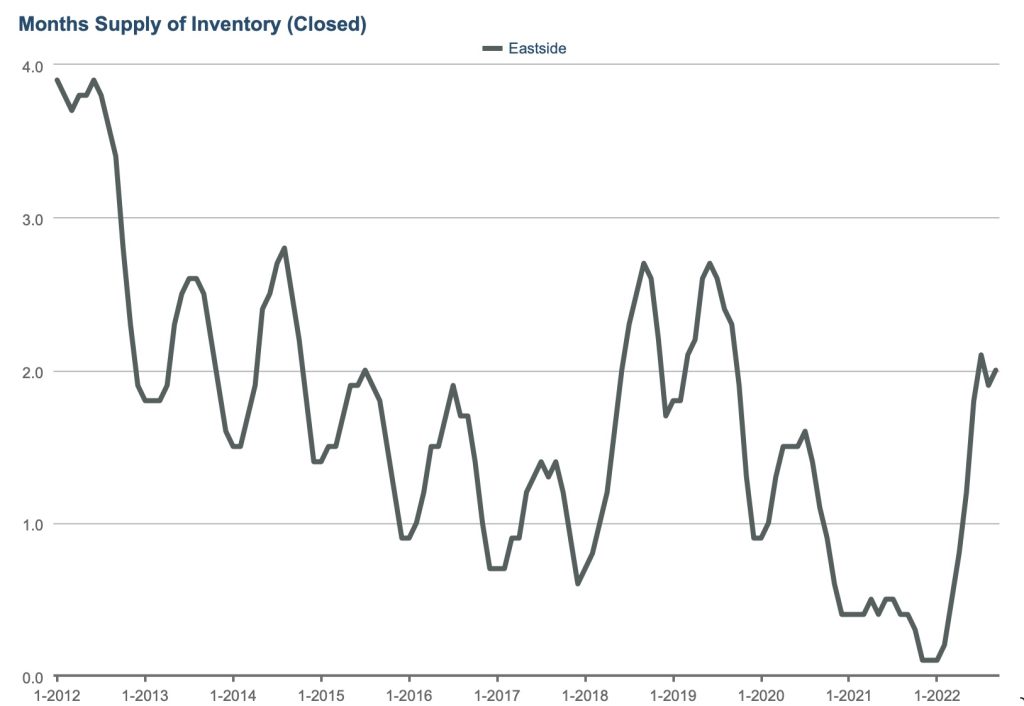

Months of supply, a measure of how long it would take to sell all the homes available, remains around two months. Not at all shocking given the increase in listings and lack of buyers right now. A balanced market is around three months of supply but I don’t expect we’ll see enough new listings through the end of the year to edge closer to that mark.