Seattle single-family May market report: median price still just shy of $1m

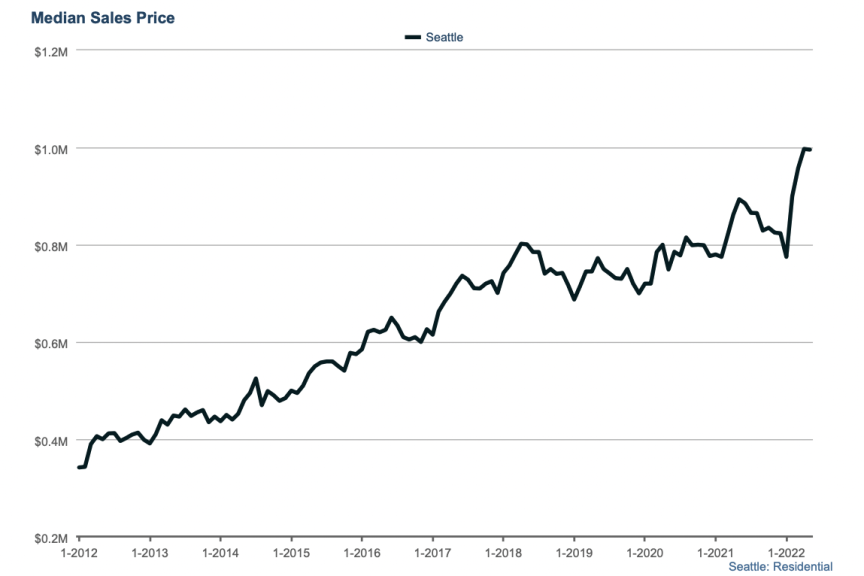

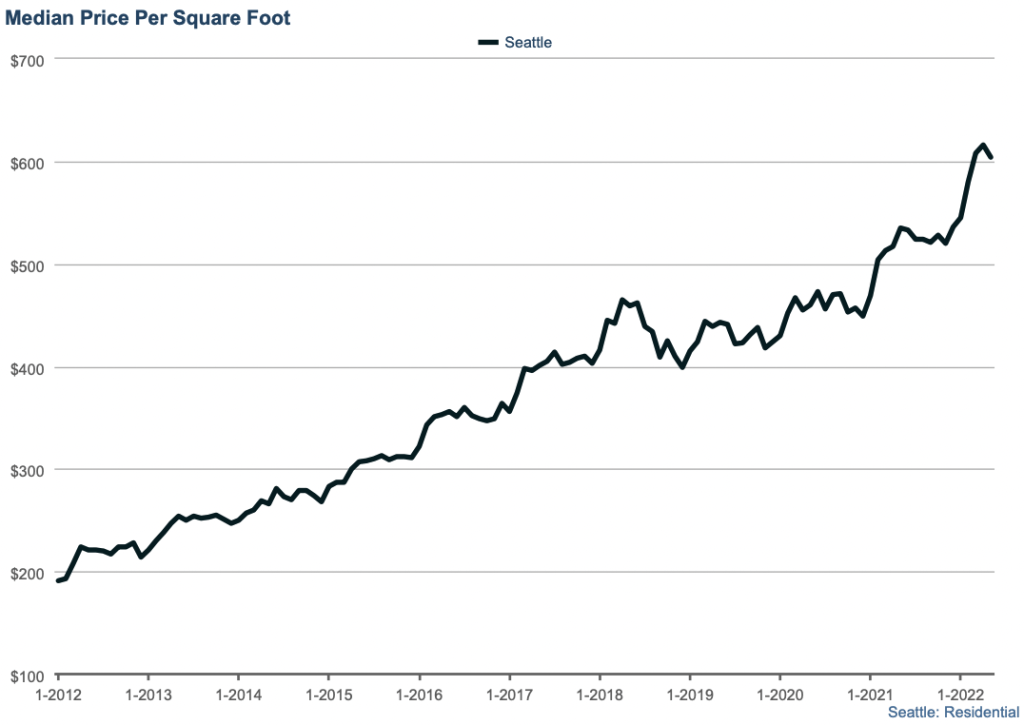

The numbers for what the Seattle single-family and townhome real estate did in May are out. The headline is that the median price is still just shy of $1m at $995,500. This is flat from April, but up $100k since last May.

Digging into the numbers we were looking for signs of cooling, but in this data, we’re not really seeing signs of cooling – the median price is flat, buyers put a lot of homes under contract and median days on market is still just 5 days. But looking forward, I expect that the median price will start to cool. It usually cools as a result of seasonality (median price typically increases in the first half of the year, declines in the second), but this year we have the added factors of a crazy first half of the year with buyers recently being hit with much higher interest rates and a declining stock market.

My takeaway for sellers – it is still a reasonable time to sell, but the market isn’t nearly as crazy as it was in the first quarter of the year, so set your expectations accordingly. You aren’t going to get 20 offers. Be happy with one or two good offers.

My takeaway for buyers – I almost always counsel patience. But right now, if you wait, prices will likely be lower, but your interest rate, if you wait until fall or winter, very well could be 6.5% instead of 5.5%.

Here’s a deep dive into all the numbers.

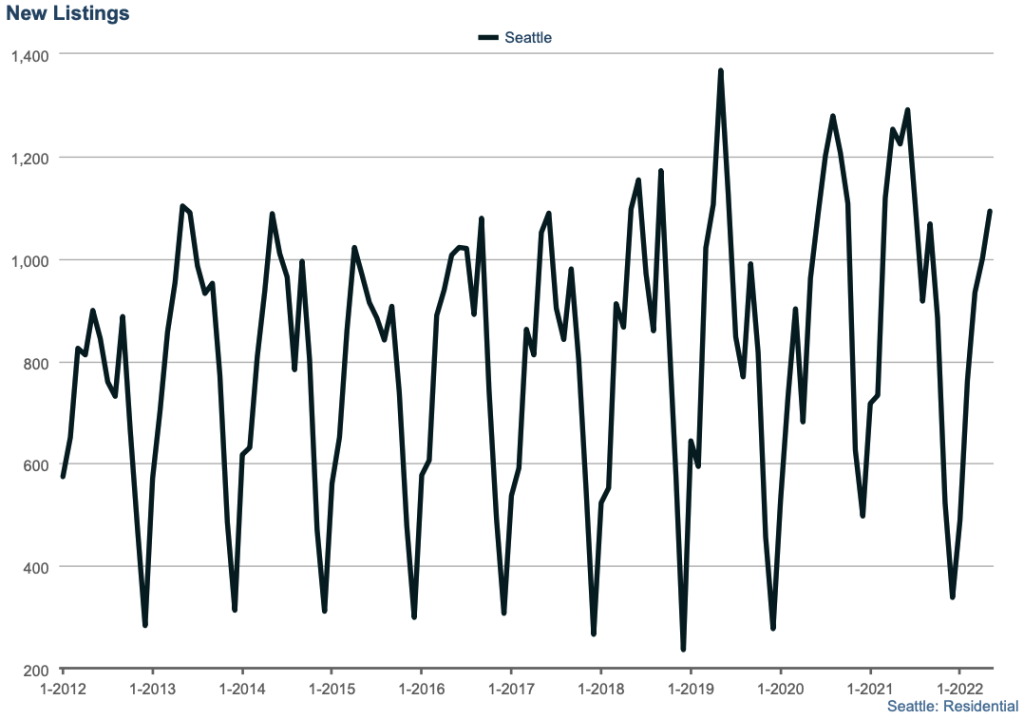

In May we saw 1,093 new listings in Seattle. This was up about 10% from April, but is less than last May’s and May 2019, though about average for a “typical” May.

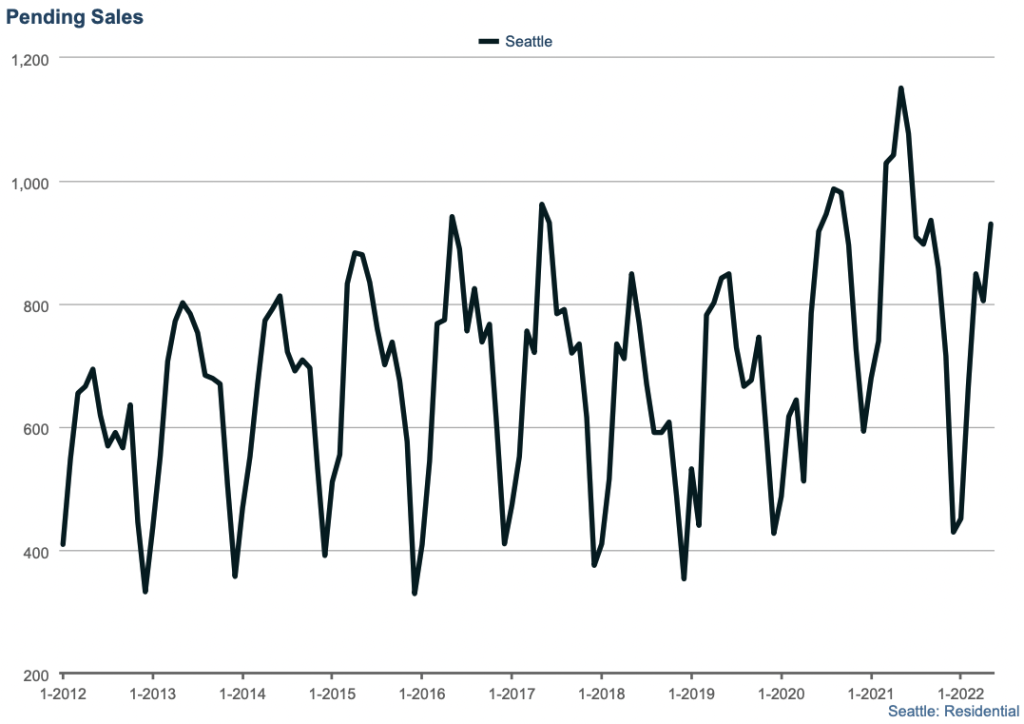

So sellers were busy listing places. What about buyers? Buyers were busy, they put 930 homes under contract in May. This was a big jump from April’s 805 and makes May 2022 one of the busier Mays (ignoring last year).

Homes continued to move fast in May.

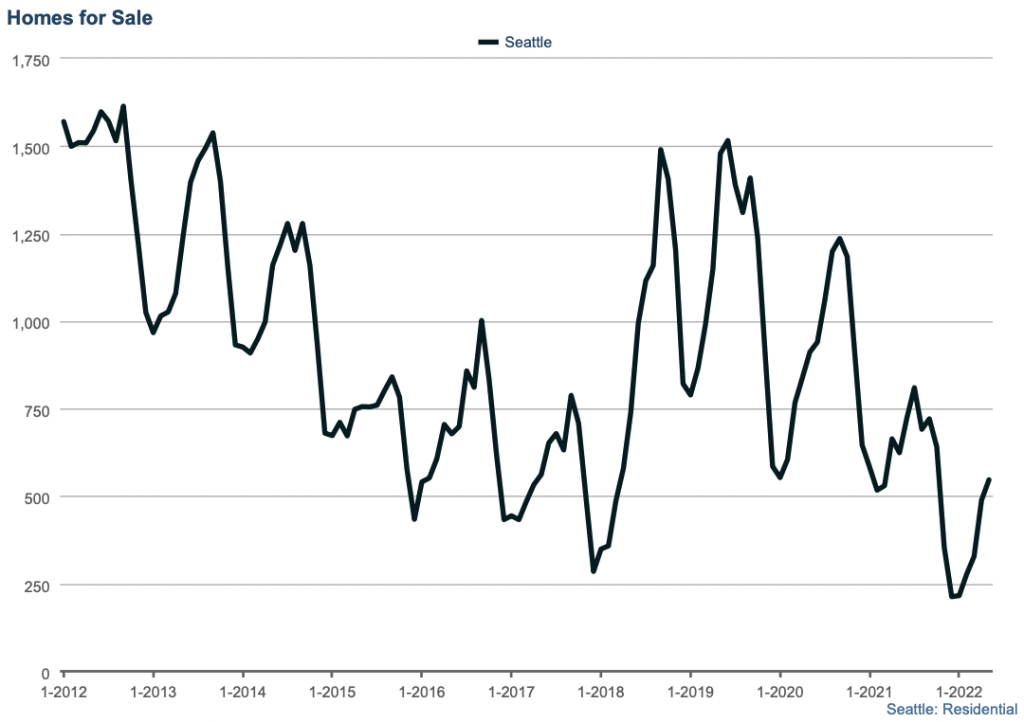

With more homes hitting the market than homes going pending, inventory grew a bit – we finished May with 545 homes for sale.

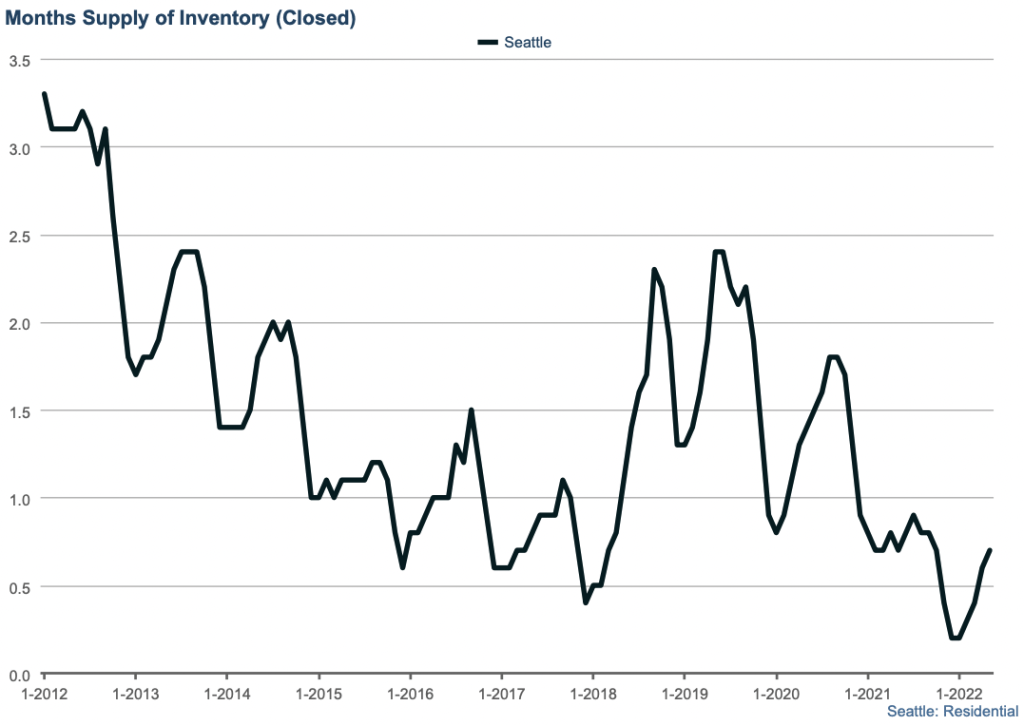

With the inventory of homes for sale growing, and interest potentially starting to wane, it isn’t surprising that the months of supply, a measure of how long it’d take to sell all the homes for sale, is increasing. But we’re far from a balanced market! (A balanced market is considered to be 3 months, which we haven’t seen in ten years!)